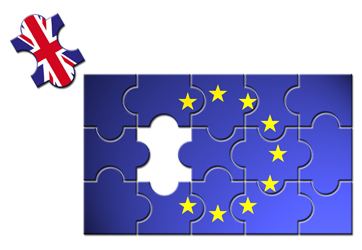

Q1 2016 – Market Commentary - Brexit

With respect to recent activities in the U.K and the resulting market activity since the Brexit vote, it is important that investors not panic and end up making the wrong decisions. What we are currently seeing in the market is a couple of things – first off the global markets had been needing a sell-off as they were getting very extended in the short-term, so this latest news has really just provided the reason, and secondly a lot of the current activity is due to institutional hedge funds exiting positions regardless of price.

The reason for the hedge fund activity is that in their mandates to investors they have promised to keep volatility to 7.5% or less (the overall volatility of the S&P 500 is 16%), so what this means is that in times like this, these hedge funds simply have to sell their holdings regardless of price in order to reduce the volatility in their funds. This activity causes a sell-off effect, but it generally only lasts a few days as the funds unload their positions very quickly, and while it makes investors nervous to see the large down moves in the market, the regular fund managers view this as Christmas coming early, as they get to pick up the stocks the hedge funds are selling at extremely good prices.

In regards to Brexit, the initial activity in the markets will calm down within a few days, and the plan for Britain begins to take shape. Given the uncertainty surrounding the outcome of the Brexit vote, most Fund Managers were keeping cash available in their funds in order to take advantage of a scenario exactly like we are currently seeing, so they can add to their existing positions at cheaper prices. One has to remember that in general, Fund Managers only seek to buy good quality businesses, and just because Britain voted to leave the EU, that doesn’t suddenly make those businesses bad businesses.

Yes, the method of conducting business in the EU is going to change in so far as Britain is concerned, but the management teams at these businesses will successfully navigate through and things will carry on. In the days, weeks and months to come, the plans for how that will happen will begin to take shape and be enacted upon in order to make things as efficient as possible, despite all the unnecessary fear-mongering that is going on in the media.

For businesses in North America it will be business as usual for the most part, there will be some change to the business methods for those that do business with the EU, but the wide spread negative news is completely needless and simply designed to capture headlines. Regardless of all that has happened throughout history in the global financial markets, they always recover and move higher than they were previously and this time will be no different. In fact, the financial crisis of 2008-2009 was far, far more serious than Brexit, and the markets recovered quite nicely within a relatively short time frame, so we shall see things begin to calm down in a few days.

In summary, we feel the investment mandates that are set forth for our clients’ investment portfolios are positioned to keep volatility to a reasonable level, and are set to seek good quality businesses and income relative to our clients’ risk level. At Ciccone McKay we build balance financial portfolios that are structured to offer funds that have excellent fundamentals and underlying value. Those fundamentals and value do not simply erode overnight as a result of Britain leaving the EU, but quite the contrary, as the resulting activity is allowing the managers to further enhance their positions at even better prices.