Q3 2020 - MARKET COMMENTARY

by Vittorio Ciccone | B. Com. | Analyst at Ciccone McKay Financial Group

Seven months ago, countries around the world declared a state of emergency, effectively locking down their economies with the measures taken to curb the COVID-19 pandemic, which has now infected millions of people globally. Due to varying lockdown measures, economic activity fell sharply; the first half of the year saw US economic activity fall by 22%, and in Q2 Canadian economic activity fell by 11.5% (down 39% annualized) (RBC, 2020). In late spring/early summer, we began to see the virus curves flatten in many areas. This provided a positive catalyst heading into the third quarter as reopening measures took place around the world, and economies attempt to dig themselves out from extreme lows.

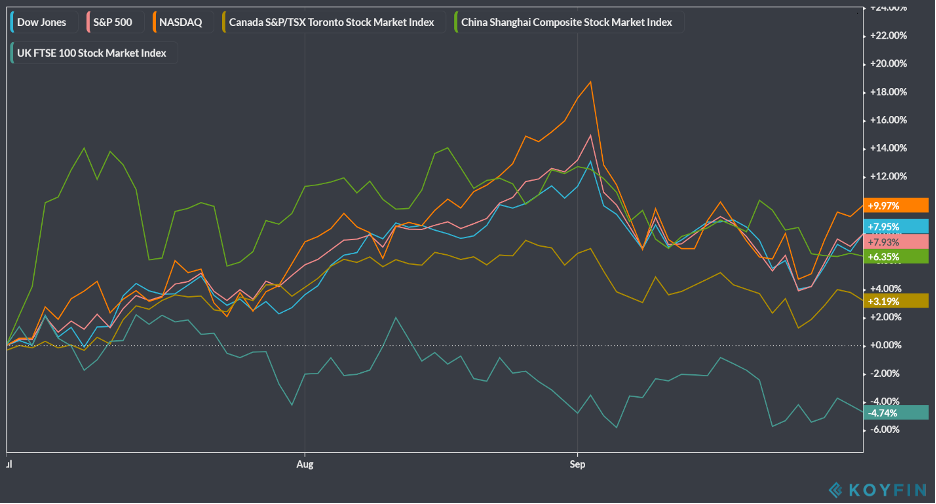

The early recovery efforts were helped by the strength in equities. The US stock market was quick to reach new record highs in early September, despite a sell-off over the month. The tech sector is still benefiting from the change in lifestyle, as working from home continues and online shopping becomes more accessible. The tech sector has been a key factor in the performance of the US equity market. Less tech-centric indices, like we have in Canada, remain below pre-COVID19 levels.

The early recovery effort has been quite impressive for both the Canadian and U.S. economies

Canadian retail sales rose 0.6% to $52.9 billion in July (Government of Canada, 2020). This increase was led by higher sales at motor vehicle parts dealers, and gas stations. The second quarter of 2020 saw a 13.7% decline in household spending (nominal terms) and an increase in the household savings rate to 28.2% as physical distancing measures left Canadians with fewer places to spend (Government of Canada, 2020). This is an incredible number and the highest savings rate since the 1960’s. In comparison, the savings rate in the first quarter of 2020 was only 7.6% in Canada.

However, with the gradual resumption of business activities across the country, retail sales in June and July were able to recover and surpass February's pre-pandemic levels.

Employment numbers are looking less grim

Furthermore, employment in Canada rose 2.4% in July, adding 419,000 jobs, and another 1.4% in August, adding 246,000 jobs. This increase in job numbers has brought employment to –5.7% of its pre-COVID employment numbers (Government of Canada, 2020).

In the US, payroll employment added 661,000 jobs in September (RBC, 2020). Combined with the increase in jobs from May to August, the US has reinstated just 50% of the 22 million jobs lost earlier this year. Of the almost 11 million fewer jobs compared with February, almost 4 million were lost in the leisure and hospitality sectors alone. Hours worked also remain 7% below pre-COVID levels (RBC, 2020).

The business sector in the US saw a sharp increase with the ISM Manufacturing index, which measures manufacturing activity from month to month, hitting 16-year highs (RBC, 2020). It is an important metric to show business sentiment as it highlights purchasing managers and supply executives who have a handle on industry supply chains.

Central Banks change their tone, but hold tight

The Bank of Canada made no major changes to key policies in September, with the overnight rate held at 0.25% and quantitative easing (QE) continuing with another multi-billion-dollar bond purchasing plan. However, the bank made one slight change to their guidance: instead of stating they are providing further stimulus if needed, the QE will be “calibrated” so it can provide the appropriate level of support. However, there is no immediate plan to stop the QE (RBC, 2020). Economists believe that the guidance will remain lower-bound until inflation is sustainably at 2% and the economy reaches full capacity.

Federal Reserve Chair Jerome Powell pledged to keep interest rates anchored near zero until 2023, vowing to keep rates low until inflation rises consistently. Short-term rates will remain targeted at 0%-0.25%.

The Fed Committee projects a decrease in GDP of 3.7% for 2020, lowering its outlook to 4% in 2021 and 3% in 2022while citing projected growth of 2.5% in 2023, the first forecast for that year so far.

Unfortunately, we might not like what comes next

Despite the run of good news, there are signs that momentum is teetering off. New COVID-19 cases around the world have begun to rise, and in North America some provinces and states are beginning to enact new lockdown measures. Additionally, major economic centers like the UK are debating a second lockdown.

On top of virus news, millions of people around the world are concerned about the benefit packages provided by the government. In Canada, with CERB benefits running out, out-of-work Canadians will need to transition to EI or a proposed new recovery package. In the UK, the popular wage subsidy has expired, which could result in further hardship. Congressional gridlock continues in the US, as both parties cannot agree on a proposed package, which has resulted in unemployment insurance set to lapse for millions of Americans. President Trump has stated discussions are tabled until after the election.

President Trump tests positive for COVID-19

President Trump, after tweeting that he and the first lady have tested positive for COVID-19, returned to the White House after three days in hospital. He was given a cocktail of experimental medications and has stated he and the first lady are doing well. With the US election less than a month away, markets wait in anticipation of the eventual result.

The reminder we all need: stay the course

One thing 2020 has taught us is that while plans can appear derailed in the short-term, it is essential, more than ever, to stick to our long-term goals and stay the course when it comes to investing. The past few months have been tumultuous; while continued uncertainty means we are not out of the woods yet, we’ve seen how quickly the markets can recover.

If the past few months have left you feeling uneasy about the future of your investments, we welcome the opportunity to review them with you to ensure that your current portfolio matches your ability and willingness to take on risk.

As always, please feel free to reach out to us at 604-688-5262 or online.

Sources:

Government of Canada, S. (2020, October 05). Statistics Canada: Canada's national statistical agency. Retrieved October 07, 2020, from https://www.statcan.gc.ca/eng/start

RBC, E. (2020). RBC Economics. Retrieved October 07, 2020, from http://www.rbc.com/economics/