2020 Year in Review - MARKET COMMENTARY

by Vittorio Ciccone | B. Com. | Analyst at Ciccone McKay Financial Group

Though the world looks to 2021 with encouragement and excitement, 2020 will surely be a year no one will soon forget. Expectations for 2021 are optimistic with the rollout of three vaccines to help combat COVID-19. Manufacturing and distributing the vaccines will take time; however, it is looking more and more evident that vaccines will be widely available by the summer, hopefully helping to ease some lockdown measures and start our path towards normalcy. So, while this second wave nears its end, and the new associated restrictions slow recovery momentarily, the consensus is economic recovery will gain momentum as the year progresses.

As we emerge from the pandemic we will be growing into a new economy. The pandemic has fundamentally changed how business and life is conducted on a day-to-day basis. Companies have consolidated labour forces, are debating bringing back workers to offices, and reconsidering if business travel is even necessary with the advancements of teleconferencing. Additionally, the global consumer has embraced online shopping, deliveries of all sorts, and online appointments for everything from medical to fitness classes. The question now becomes, how much of these changes are permanent? And what impact will these changes have on the imminent economic recovery and future growth prospects?

Canadian 2020 Lookback:

Canadian Gross Domestic Profit (GDP) increased in November, despite the new lockdown measures. The third quarter saw GDP raise by 9%, short of the 10% increase that the Bank of Canada expected. Q3 GDP remained 5% lower than the 2019 levels, but despite the record quarter over quarter increase, the gap year over year remains well below the Great Financial Crisis (GFC). The loss of recovery momentum is likely going to persist through the early months of 2021 as several provinces are maintaining lockdown measures, and Quebec and Ontario strengthening lockdowns by adding curfews and stay-at-home orders.

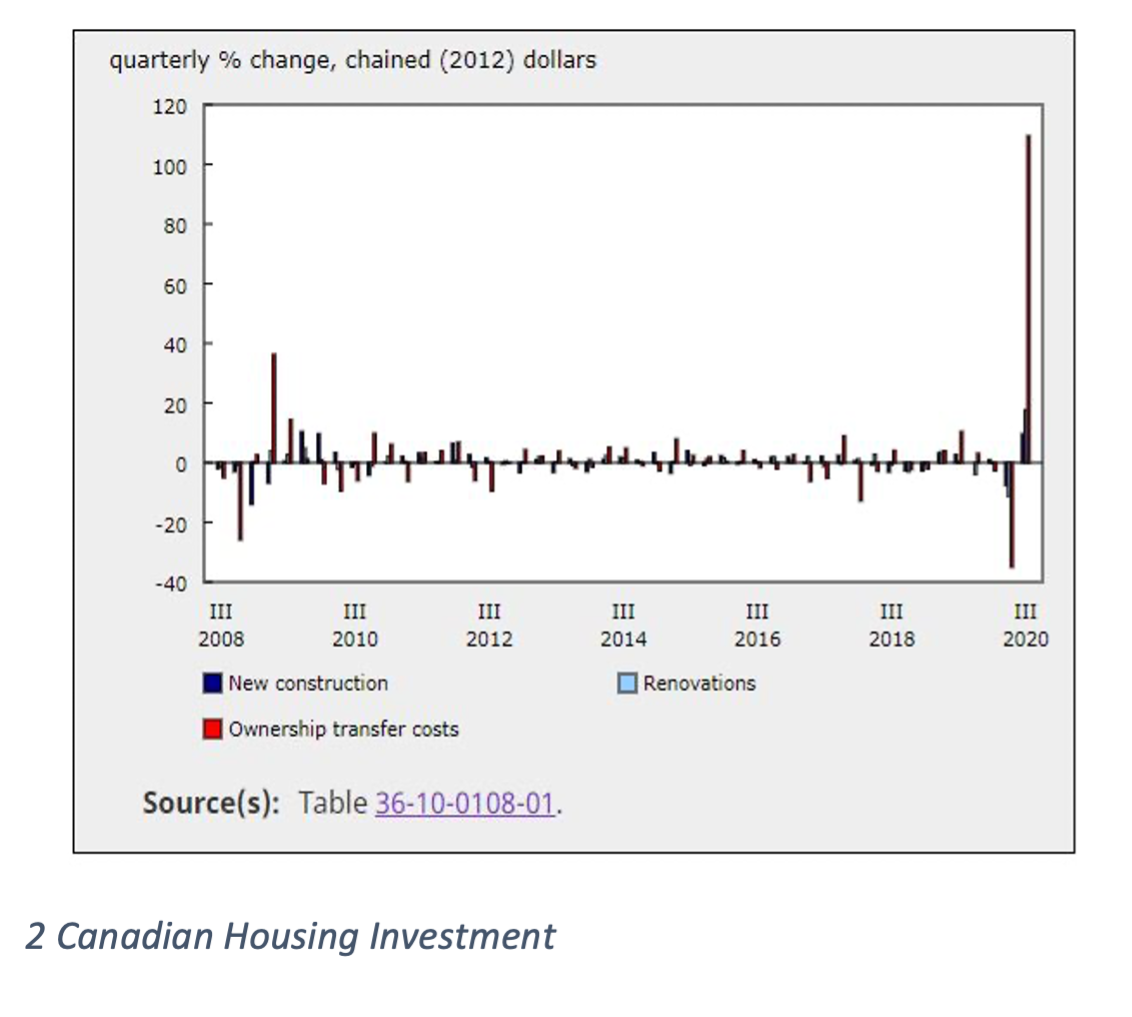

Canadian households were the main driver of economic activity in 2020, as residential investment jumped to an all-time high on strong home sales and housing starts. Consumer spending on goods also eclipsed pre-Covid-19 heights. The service sector lagged in spending as restrictions remained on industries that require close proximities. According to RBC, business investment saw a slight bump, as oil and gas capital expenditure is subdued. Despite this, Canada still has a long road ahead to get close to pre-pandemic numbers. However, this marginal increase in economic data is positive. It will be hard to sustain as restrictions are ramped up, and other lockdown measures are implemented in varying parts of the country. Economists predict that Q4 2020 GDP numbers will grow 1%, while Q1 2021 will see a 3.5% growth.

The recovery momentum has the potential to be accelerated with quicker distribution of the vaccine. As the year ended, we saw front-line healthcare workers and vulnerable demographics receive the vaccination. As of January 2021, a total of 230,000 Canadians have received their first vaccine dose. The broader population is slated to start receiving the vaccine during the summer months.

The Canadian government was able to purchase enough vaccines for every citizen, and by the Fall, the Prime Minister's office has stated the vaccine will have been accessible to all Canadians. Getting the vaccine out to all citizens may prove to be a positive catalyst for the beaten-down food service, travel, and entertainment sectors, as consumers will have more opportunity to spend.

The Bank of Canada (BoC) maintained the 0.25%-overnight rate and continued their Quantitative Easing (QE) program. QE will continue into 2021; however, the bank has stated that they will start winding down the program as the economy improves. Stimulus will be in place through 2021 and the BoC was optimistic on the Canadian outlook, though the vaccine led recovery timeline remains uncertain.

US 2020 Lookback:

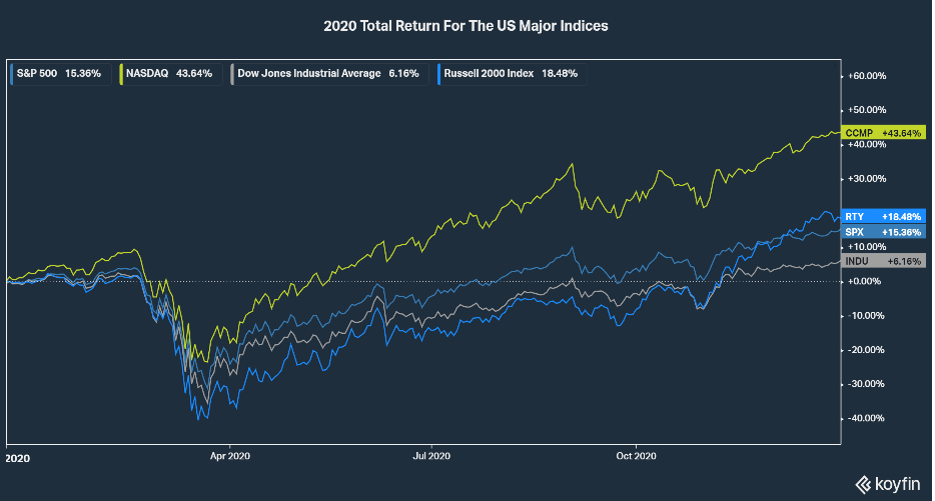

With the US election uncertainty easing and Joe Biden emerging the victor, alongside the positive vaccine news and global rollout, risk-on behaviour emerged, and it led to the Dow Jones Industrial Average, the S&P 500 and the Nasdaq all reaching new record highs in 2020. The increase was due in large part to the FAANG (Facebook, Apple, Amazon, Netflix, Google) and other growth names, as they saw their share prices accelerate quickly even during suppressed economic conditions. Nevertheless, we saw a rotation out of growth-orientated companies and into more of a value tilt. Financials, energy, and small-to-mid-cap names outperformed towards the year-end, which helped lift the major indices to new highs.

Beyond the stock market, the US is still dealing with large spikes in COVID-19 cases, as hospitalizations in the US have doubled in the summer months. President Biden is hoping to get the vaccine rollout in the US moving quicker, as he is pledging to distribute 100 million shots over his first 100 days. Considering this, the US economy has held up well during the soaring COVID-19 cases. However, issues are beginning to come to light, as only 68,000 jobs were added in December compared to 245,000 a month earlier. That is the lowest tally since May. Economists though, have reason to be optimistic as the pandemic-relief package of $900 billion will be pumped into the economy, Americans savings rate are unusually high, and borrowing costs are low. It goes without saying that near-term economic activity will remain muted as states and cities start to tighten their stances on activities to better contain the virus; however, vaccines will reassure people to go out and return to normal activity.

Right before the new year, Congress agreed on a new $900 billon dollar relief bill, along with $1.4 trillion to fund government programs. The stimulus measures include $600 cheques to Americans who meet the requirements and $300 top-ups of other federal programs.

The Federal Reserve committed to buying bonds until the economy reaches full employment and inflation stays around 2%. The Fed will also maintain rates close to zero. In recent meetings, the Fed has discussed the notion of increasing the terms of the bond being purchased, as it will help keep long term rates stay low and reduce borrowing costs. The Fed is now facing tough questions as to how they plan on tackling the undue risk-taking and asset bubbles being formed in various markets. The Fed is also expecting a 2.4% decline in GDP in 2020 an improvement from the 3.7% that was predicted in September.

Important to keep an eye on:

The UK and EU finalized a trade deal, days before the Brexit transition period was scheduled to end. The deal will ensure tariff-free good trades. Key financial services discussions have been extended and there will be a ruling shortly; no immediate deadline has been set. The UK has been in new lockdowns as a variation of COVID-19 was discovered.

Additionally, The US Federal Trade Commission (FTC) filed a lawsuit which seeks to force Facebook to sell Instagram and WhatsApp. The FTC is trying to do what has not been done since 1984, which is to break up one of the US’s largest companies; the last company to be broken up was AT&T. What the FTC is stating is that acquisitions took place to destroy upstarts and limit competition, as part of Facebook’s larger strategy to monopolize social media. Additionally, the Department of Justice (DOJ), is pursuing a monopoly case against Google for packaging its search engines into phones and browsers. According to Bloomberg, the DOJ case is a mere replica of the anti-trust case that Microsoft was part of in 1998.

Though these cases will be drawn out over years, these cases will set the course for American antitrust law for the foreseeable future.

As always, please reach out if you’d like to talk about your own investment portfolio. We love to hear from you.

Sources:

Brody, B. (n.d.). Retrieved January 05, 2021, from https://www.bloomberg.com/news/articles/2020-12-16/facebook-fb-antitrust-case-has-much-different-goal-than-google-s-googl

"Capital Market Assumptions - Institutional." BlackRock, 2020, www.blackrock.com/institutions/en-us/insights/charts/capital-market-assumptions.

Government Of Canada, S. (2020, December 01). Chart 4Housing investment. Retrieved January 05, 2021, from https://www150.statcan.gc.ca/n1/daily-quotidien/201201/cg-a004-eng.htm

JeffCoxCNBCcom. (2020, December 16). Fed commits to keep buying bonds until the economy gets back to full employment. Retrieved January 05, 2021, from https://www.cnbc.com/2020/12/16/fed-decision-december-2020-fed-commits-to-keep-buying-bonds-until-the-economy-gets-back-to-full-employment.html

Leadership, R. (n.d.). Digest - December 2020. Retrieved January 05, 2021, from https://royal-bank-of-canada-2124.docs.contently.com/v/digest-december-2020

Torry, H. (2021, January 03). Economists Expect Tough Sledding in Winter, Then a Rebound. Retrieved January 05, 2021, from https://www.wsj.com/articles/economists-expect-tough-sledding-in-winter-then-a-rebound-11609669800