2021 Q1 - MARKET COMMENTARY

by Vittorio Ciccone | B. Com. | Analyst at Ciccone McKay Financial Group

The year began with vaccine production and vaccine distribution ramping to new highs. As a result, global GDP is on pace to increase by5.5% in 2021 according to data from the International Monetary Fund (IMF). This growth in GDP is accompanied by the consensus that central banks around the world will maintain status quo and fiscal support will remain or even increase. However, a viable reopen is being tested as uncertainty grows around COVID-19 variants and the ascending third wave. Variant cases are on the rise in the US, Canada, Europe, and India, which may impact vaccine distribution and dampen the pace of a reopen.

Currently, the US and UK are outpacing the rest of the world with vaccinations; the US has administered 171 million doses (33% of population receiving first dose), while in the UK, they have given 37 million doses (8.2% of population). Canada (6.76 million doses) and Europe (and EEA—82 million doses) are expected to make up for lost ground towards the latter half of the year.

With global vaccine rates continuing to rise, the high-contact industries that have remained weak throughout the pandemic, like travel and hospitality, will begin to show improvements. This should settle some of the unease we have been experiencing in the recovery thus far.

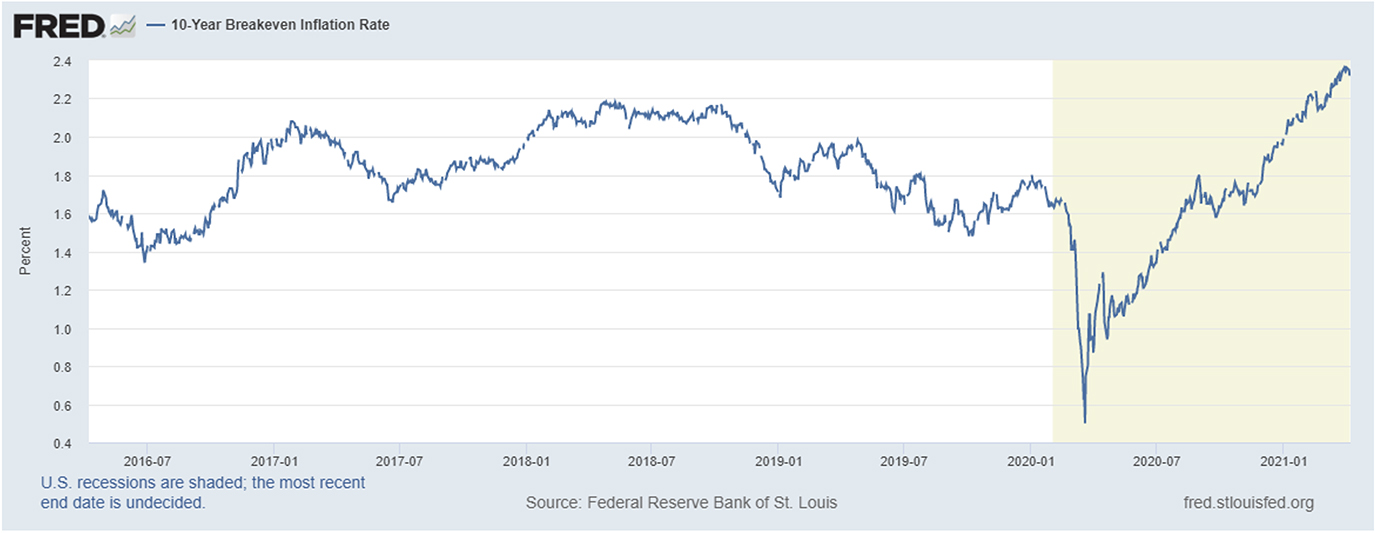

With economic growth continuing to pick up as the year progresses, the additional monetary and fiscal policy support has many people concerned with inflation pressure. As commodity prices rebound from last year’s lows, and household consumption increases, prices should increase into next year; however, the price pressure that would cause central banks globally to alter their monetary policies is unlikely—unless expectations get a massive bump.

Canada:

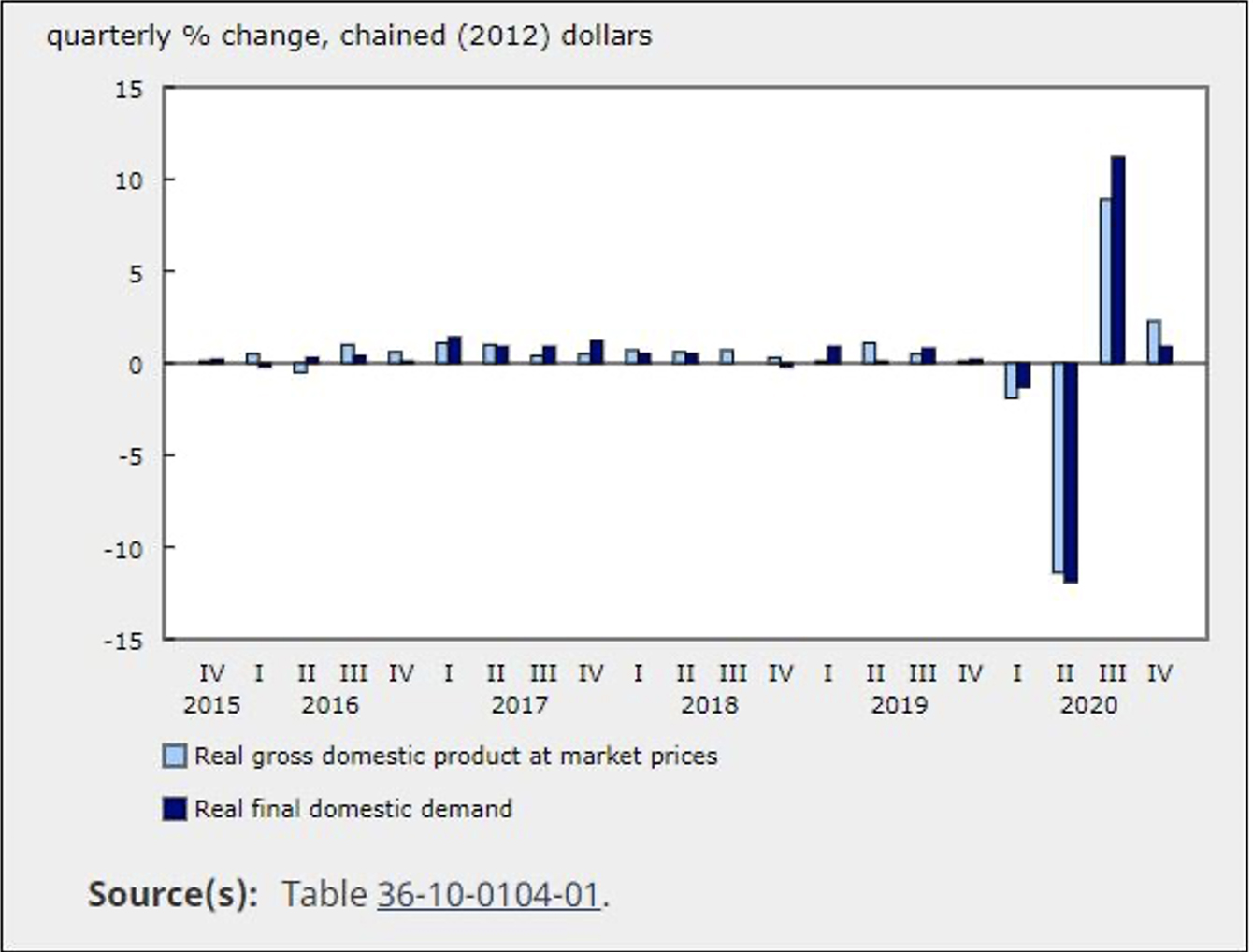

In 2020, we saw Canadian GDP fall roughly 5.4%; it was the steepest decline since quarterly data had first been recorded (Canada, 2021). GDP grew substantially towards the end of the year and continued that momentum into 2021. Even with containment measures in place, the Canadian economy continued its rebound, leading RBC Economics to upgrade its growth projections to 6.3% for 2021 and 4.1% in 2022.

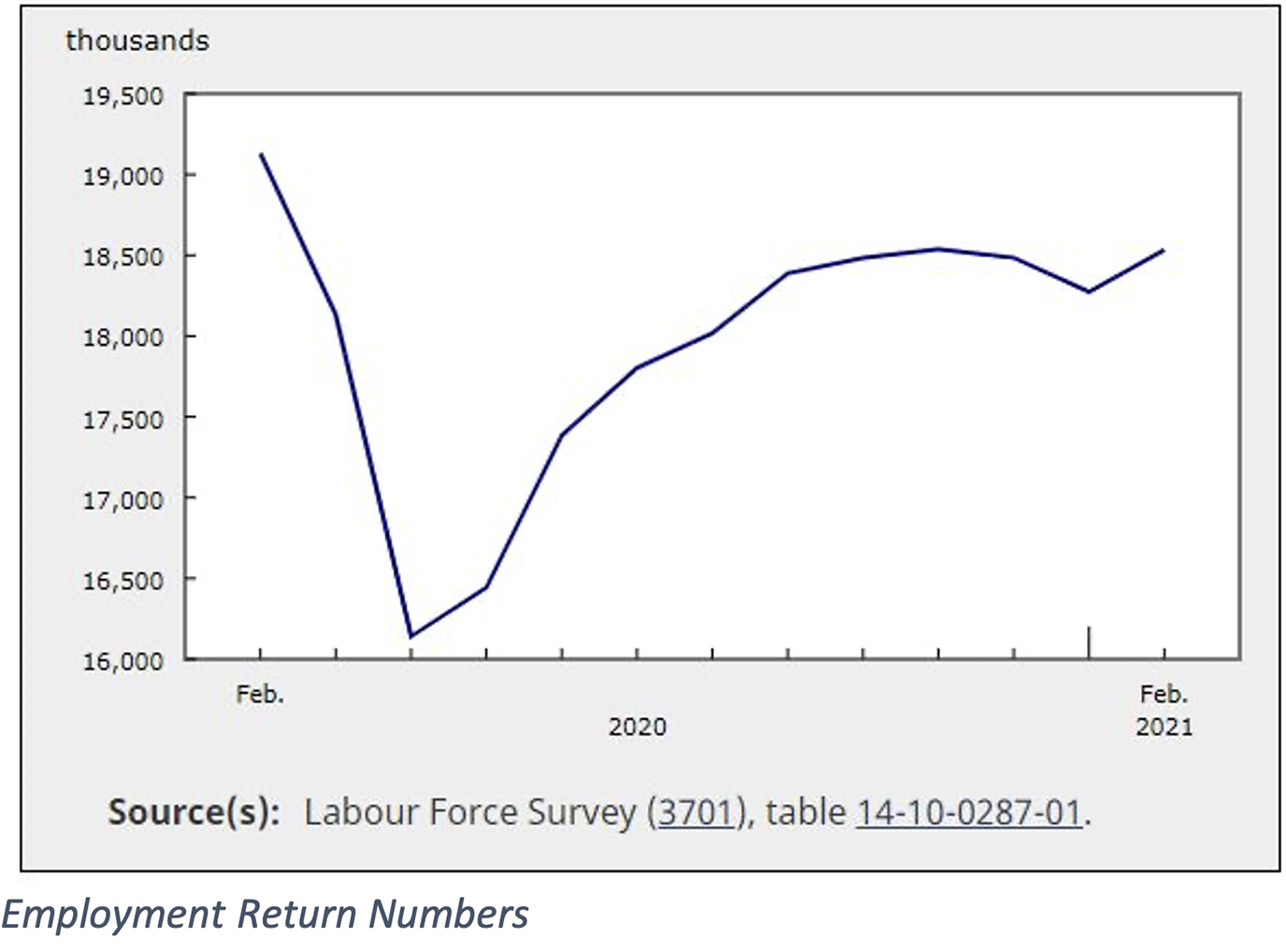

GDP growth and a promising outlook aside, COVID-19 and variant cases are surging in Canada as Ontario, Quebec, Alberta, and British Columbia all enact new lock-down measures—including Ontario initiating a full stay at home order. As a result, the unemployment rate ticked higher, up to 9.4%, to start the year with more than one million people losing their jobs because of the new restrictions. However, in February unemployment hit the lowest levels since March 2020, at 8.2%, as growth continues (Canada, 2021). Economists predict this number to tick lower as hard-hit sectors begin to recovery and rehire workers.

Employment Return Numbers

Government support will remain in place throughout 2021—the federal government is planning on an additional $100 billion over the next three years for programs focusing on childcare and climate change, which should spur additional growth. The Bank of Canada (BOC) provided a moderate to upbeat forecast as they project a 4% GDP increase this year and 4.8% in 2022, while keeping the overnight rate at 0.25% until conditions are met in 2023. The BOC will be monitoring activity closely and make a calculated decision on when to remove stimulus.

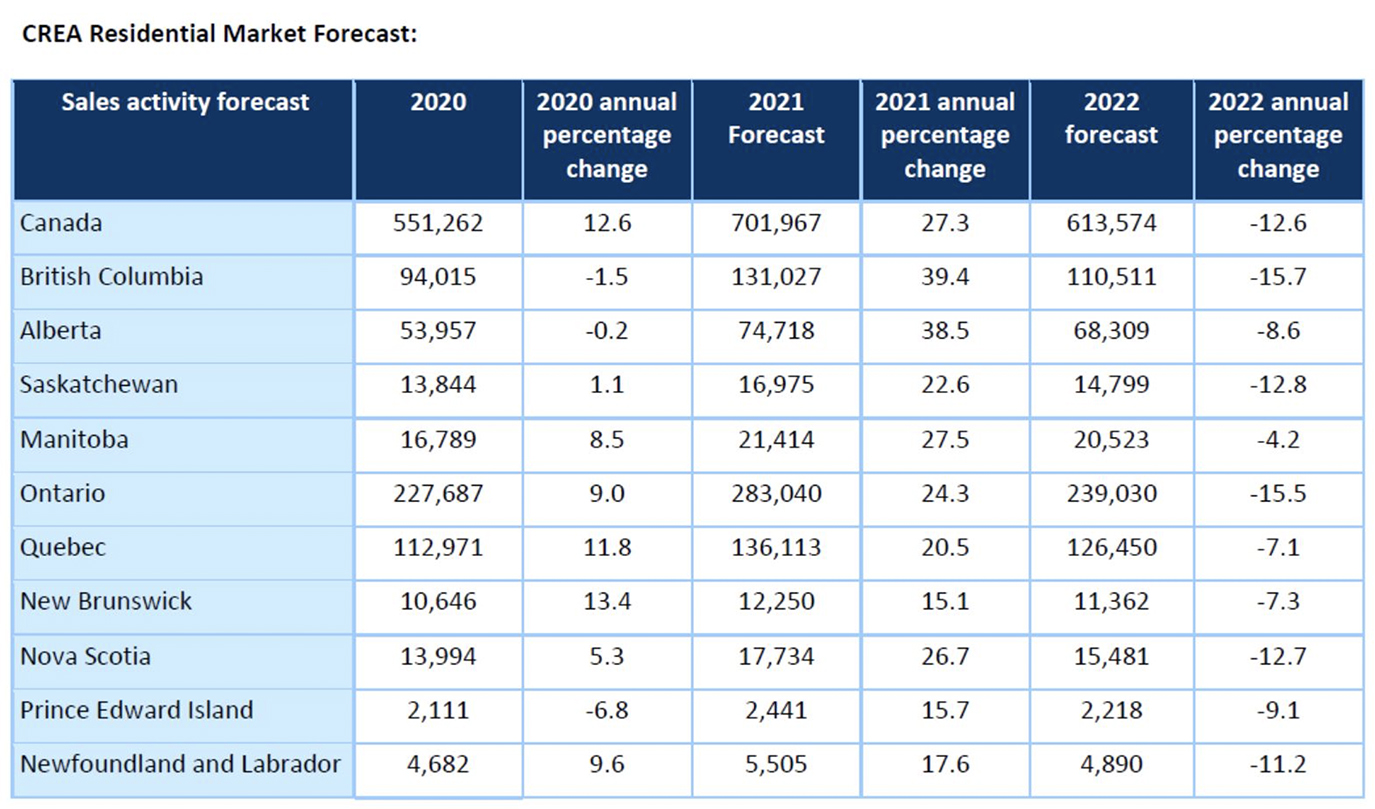

Despite the pandemic and lockdowns, Canadian housing had it strongest year in 2020 and its momentum has continued in 2021. Prices on homes have spiked higher, as the basic economic principal of strong demand and low supply are being met. RBC Economists expects an average increase in home prices to be around 8.4%, with that said they are predicting a slow down as we approach 2022 due to modestly higher interest rates and lower affordability.

United States:

To start the year, the US economy has rebounded quite well. With their vaccine rollout continuing (33% of population with one dose, 19% fully vaccinated), the new $1.9 trillion relief package beginning, and a proposed $2 trillion infrastructure plan, the US economy is expected to fully recover its pandemic related losses by the middle of the year (RBC Economics, 2021). RBC Economists are forecasting a GDP upgrade to 6.2% in 2021 and 3.3% in 2022. Furthermore, the labour market continues to rebound as the unemployment rate hit 6.0%. The Bureau of Labor and Statistics stated that job growth was widespread, but they saw major gains in leisure and hospitality, education, and construction.

The Federal Reserve’s (FED) use of the flexible inflation target means that the FED will allow for inflation to run above 2% for a time, as their target is an average of 2%. Like the BOC, the FED is in no rush to raise policy rates; however, if inflation takes a massive leg up, they may be forced to act. In saying this, the American central bank will let the US economy run to ensure they meet their goal by the end of 2022.

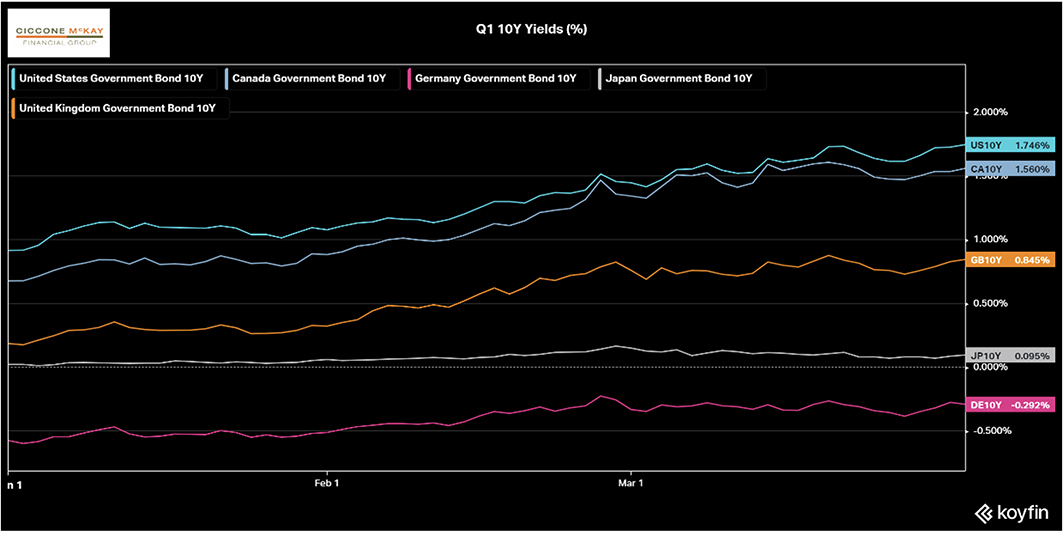

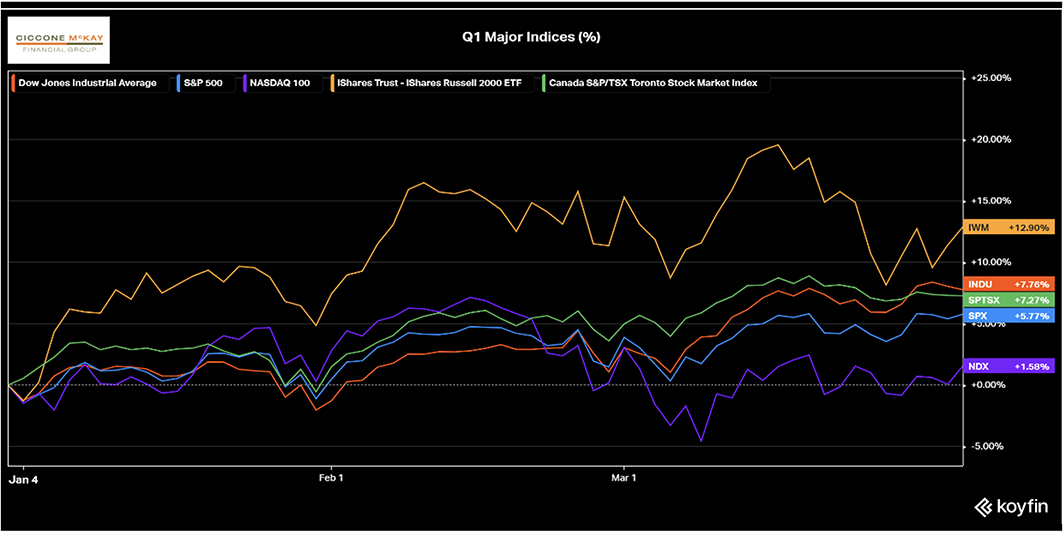

Global Yields and Stock Market:

Longer duration yields continued their march higher in the first quarter of 2021. This rise in yields has resulted in an increase in volatility throughout equity markets. With more and more people becoming vaccinated and the world opens, consumption and exuberance will continue to increase throughout the year, likely sending rates higher.

Indices around the world saw a rotation in the market to start the year, from large growth names to value or “the re-open trade.” The Russell 2000 led all other indices returning 12.90%, while the NASDAQ lagged, returning only 1.58%, showing the shift in stock market activity. Inflows into the stock market remain at highs. With the increase in rates and the corresponding risk-free rate, expectations are for value sectors like financials to outperform over the next few months.

As always, please reach out if you would like to talk about your own investment portfolio. We love to hear from you.

References:

10-Year breakeven inflation rate. (2021, April 07). Retrieved April 08, 2021, from https://fred.stlouisfed.org/series/T10YIE

CDC COVID Data Tracker. (n.d.). Retrieved April 08, 2021, from https://covid.cdc.gov/covid-data-tracker/#datatracker-home

THE EMPLOYMENT SITUATION — MARCH 2021. (n.d.).

Government of Canada, S. (2021, March 02). Gross domestic PRODUCT, income and expenditure, fourth Quarter 2020. Retrieved April 08, 2021, from https://www150.statcan.gc.ca/n1/daily-quotidien/210302/dq210302a-eng.htm?HPA=1&indid=3278-1&indgeo=0

Official UK Coronavirus Dashboard. (n.d.). Retrieved April 08, 2021, from https://coronavirus.data.gov.uk/details/vaccinations

Quarterly Forecasts. (n.d.). Retrieved April 08, 2021, from https://www.crea.ca/housing-market-stats/quarterly-forecasts/

Vaccines put global economy on recovery track - rbc economics. (2021, March 10). Retrieved April 08, 2021, from https://thoughtleadership.rbc.com/vaccines-put-global-economy-on-recovery-track/?_ga=2.17075449.1780760959.1617819576-945916762.1617819576