Year in Review: A volatile 2022, though possibly some brighter prospects ahead

by Vittorio Ciccone | B. Com. | Investment Analyst at Ciccone McKay Financial Group

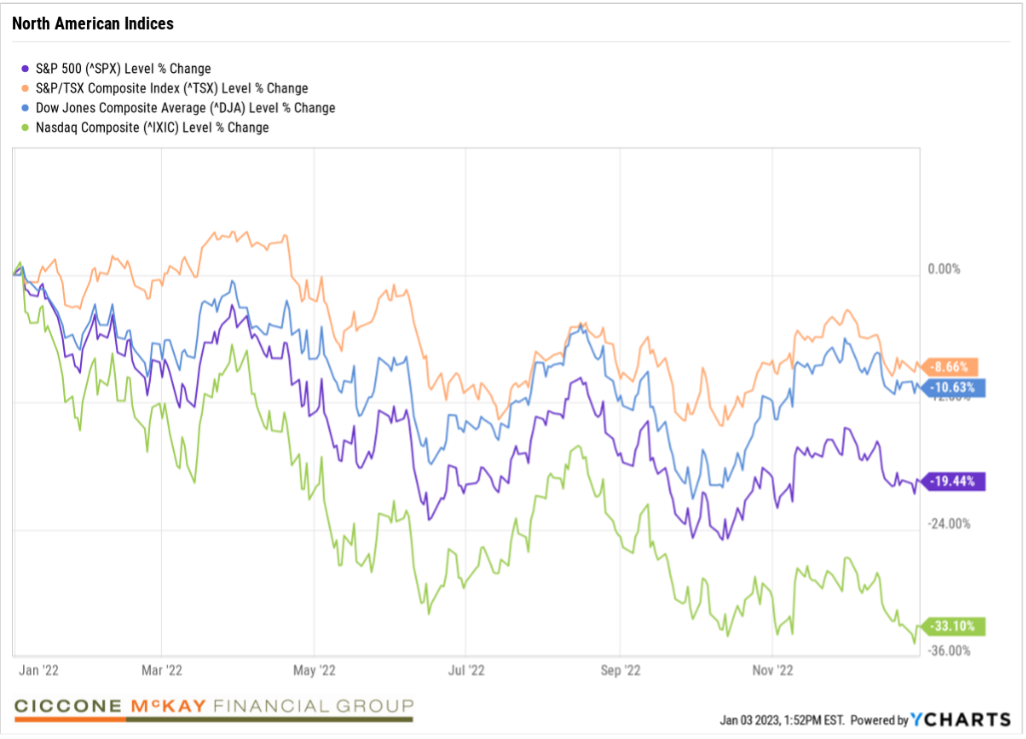

2022 was quite the year! Filled with market curveballs, it also had extended periods of volatility. The result: Major market indices snapped a three-year winning streak. And that wasn’t the only battering investors took. For the first time in a long while, the strategy of diversification with stocks and bonds failed, neither diversifying nor reducing risk.

The bear market that dragged on throughout the year, causing all sorts of economic issues, can be summarized in four words: inflation and interest rates.

In this Year In Review, I will be recapping 2022’s major events. A personal note: Despite all volatility of 2022, I am excited to turn the page and start a new year. I wish everyone reading this a happy and healthy 2023.

The biggest story: inflation

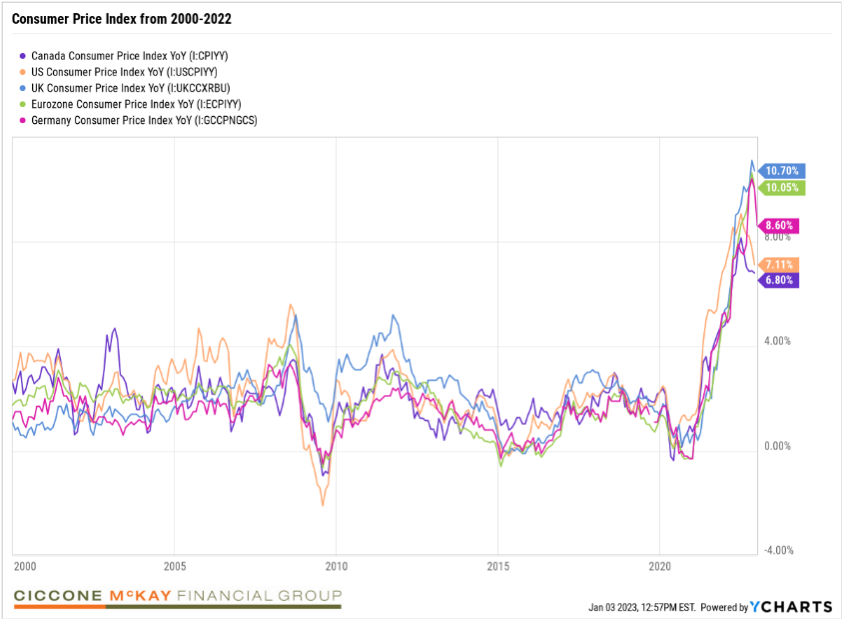

During the pandemic, governments around the world stepped in with an unprecedented creation of money. At the time this seemed an appropriate measure to calm the panic. However, it resulted in inflationary pressure. As stimulus cheques hit bank accounts and personal savings increased, consumers were in a better position to spend. The increase in demand, along with the continued slow unwinding of supply-chain pressure, forced prices higher in 2022.

Adding fuel to the fire, the Russian invasion of Ukraine — a war between two major commodity producers and exporters — led to deglobalization. Prices had already been increasing because of excess spending/liquidity and demand pressure. The war sent oil prices spiking to new highs. This spike caused an energy and natural gas crisis in Europe, especially Germany, France and the United Kingdom, which rely heavily on Russia. Oil being a major input in the global supply chain, the results were increases in: the cost of raw materials; natural gas prices (heating); and fuel prices. For a while it felt like things were utterly broken.

Another result was these excess costs getting passed to the consumer. The Consumer Price Index (CPI) baskets of major global economies soared to figures not seen in many decades.

The importance of globalization

It is important to note that globalization has been a major cause of price decreases over the decades. As manufacturing moved to less developed economies, input and production costs came down. Now, with the slow pull-back of globalization and greater expense of certain goods’ production, the global economy faces increasing inflation.

Russia shutting off the oil taps to Europe revealed the fragility of the global energy infrastructure. This fast-tracked efforts to develop alternative sources, as well as diversified sources, to prevent such future disruptions from occurring. On the technological front, the United States fears China may invade the world’s semiconductor leader, Taiwan. For that reason, the US is now subsidizing the semiconductor industry.

All of the above filled 2022 with sanctions and ever-more-complicated trade talks – putting even more pressure on supply chains and capital spending.

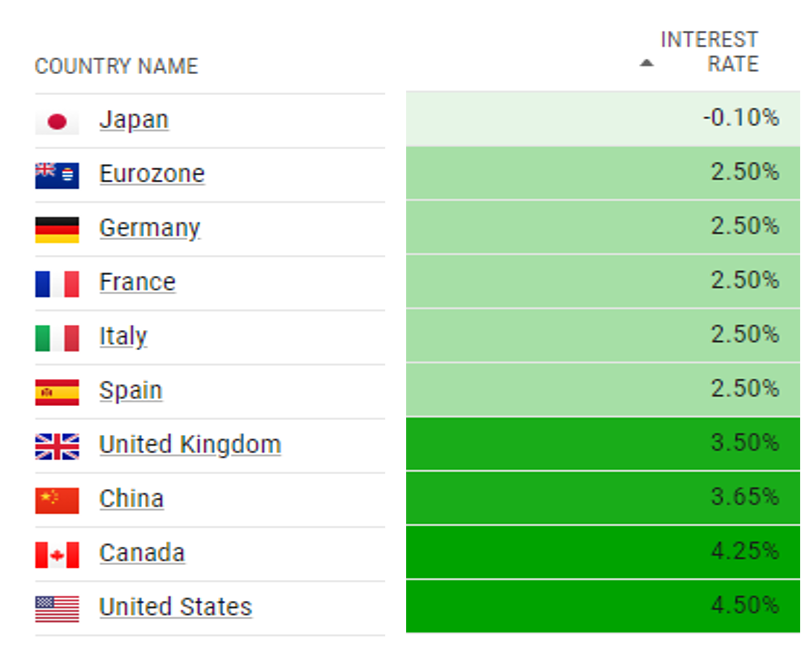

Central bank intervention

For the first time in over three years, the global central bank leaders, starting with the Bank of England (BofE), initiated a series of rate hikes. With inflation levels not seen since the ’70s, many market historians were looking for a road map that wouldn't involve channelling Paul Volcker.

For those who don’t know, Volcker was the US Federal Reserve chair when inflation averaged 11.2%, peaking at around 20% in 1981. To combat inflation, Volcker raised the prime rate to over 21.5%. He theorized that inflation is worse than any recession or bouts of unemployment, and must be stamped out at all costs. However, by raising the rate, Volcker put the US into a recession. The unemployment rate rose to around 10%.

Initially central banks thought inflation would be transitory. However, as the structural forces around inflation became persistent, that proved wrong. Along with wages, core inflation — that is, all prices excluding food and energy — began to increase and stick. As a result, central banks around the world needed to get ahead of the inflation and raise rates to combat the rising prices.

Higher interest rates impact every single part of the economy. They increase the cost of capital, which forces people away from borrowing to grow businesses and buy homes. This then directly impacts the real economy. Moreover, it hurts asset prices, which reflect future cash flows. Asset prices get discounted back to current values; when the discount rate increases, the intrinsic value falls. Using the stock market as an example, the highly speculative growth names were the companies most affected by the discount rate changes. Intuitively, this makes sense as these companies are the ones promising cash flows further into the future.

The good news is inflation is starting to show signs of retreat--energy price effects are starting to fade. On the other hand, core inflation is proving stickier. Economists say it is too early for global central banks to pull back from the fight against inflation. But, with global economic activity showing signs of slowing down, the hope is that we have passed the peak of the policy rate increases.

Domestically, the Bank of Canada has signalled that it may pause rate increases in the new year. The Fed, BofE and European Central Bank (ECB) are still expected to raise rates modestly. The question now becomes: How long will these governing bodies hold rates at these levels? The focus will be on the Fed, as the global central banks will take their cues from Chair Jerome Powell and his team.

Nowhere to hide

With interest rates rising, the 2022 bond market went into a spiral. Prices fell fast (rates and prices move inversely). Bonds compete with one another on the level of interest income they provide to investors. So, when interest rates go up, newer bonds have higher interest rates, meaning that older bonds get priced at a discount.

As a result of the rapid increases in quick succession, it has been a tough environment for bonds. For the first-time bonds and stocks moved from a mainly negative correlation to a positive one. This means less diversification in traditional stock and bond portfolios. According to traditional investing wisdom, the right mix of stocks and bonds should help provide each with the proper mix of risk and return. This didn't happen in 2022. The silver lining: Bonds are looking much more attractive, as rates are up significantly. Many economists and bond investors are saying the worst could be behind us.

As I mentioned earlier, the equity markets took a hit after multiples compressed due to the discount rate changes. High-growth companies led this trend by spending to pursue massive growth. As such companies mature, they focus on profitability and operating efficiency. The longer that cash flows are seen into the future, the more of an impact a rising rate environment will have on them.

Rising rates, lowered bond prices and collapsed multiples of companies fuelled by less money supply due to central bank intervention – all these combined to create a perfect storm. Many stock and bond portfolios tumbled. In fact, the traditional 60/40 portfolio had its worst year since 1931.

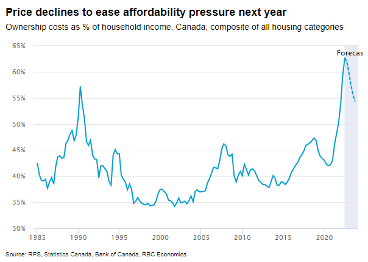

It wasn’t only stocks and bonds that suffered; also real estate, due to the rising rate environment. The value of Canadian assets, according to Bloomberg, fell the fastest since the 2008 financial crisis. The increase in rates has made it harder for Canadians to buy homes and maintain servicing costs.

Of housing, the Royal Bank of Canada says, “The massive erosion of affordability has kept Canada's housing market on a major correction course since spring. Home resales have plummeted 36% nationwide — more so in BC (-43%) and Ontario (-41%) —reaching levels far below those that prevailed pre-pandemic. The pace of decline has eased in recent months, though. Falling prices also appear to be slowing. These may be early signs the correction is approaching its final stage.”

To sum up

No question, this past year was one for the history books. Many structural shifts occurred, with higher rates, inflation, potential deglobalization and energy issues. And wherever you held value, whether in property, stocks, bonds, etc., that value decreased.

However, there are a few positives. Bear markets are a perfect time to rethink your financial planning, as increased savings rates can go a long way to boost your future finances. If you do not have a financial plan, the current era could serve as a useful catalyst for you to chat with a fiduciary. This professional advisor can better equip you with the tools you need to be properly situated, not just for when years like 2022 occur — but for all your future.

As always, for more information about Ciccone-McKay Financial Group, or if you want to chat with someone at the firm, we welcome your call: 604-688-5262.