How best to build your retirement income? PAC in the savings!

WITH A PRE-AUTHORIZED CHEQUING PLAN YOU SAVE FIRST, SPEND SECOND – AND ENSURE A SOUND FUTURE

No one would argue that saving for retirement is a great idea. It’s something we all know we should do. But whether we put the idea into action is another issue. How many of us, when we come down to it, are good savers? Are you?

Turns out that, on average, we Canadians are pretty dismal at saving. According to Statistics Canada1, the current household saving rate is hovering around 4%, a percentage that has fallen drastically since the 1980s. Yet we’re in a time that has seen a rise both in the cost of living and in stock-market volatility. Now, more than ever, it’s vital to ensure you set up a savings plan to provide sufficient income for your retirement years.

So how can you, as a hard-working person, ensure that this happens?

Consider that the maximum contribution to a Registered Retirement Savings Plan (RRSP) is 18% of your T4 income in the previous year. And, that the maximum contribution in 2016 is $25,370.

That means, on average, there is a 14% gap between what we are saving and what we can be saving, solely in RRSPs. And that is excluding all other registered accounts entirely, such as a Tax-Free Savings Account (TFSA).

Maybe you’ve put off saving because it seems like a chore. Here’s a tip for you. Saving gets easier when you make it a habit!

Okay, you say, but how to establish this good habit of saving?

Get in the saving habit with a PAC

One simple way to get in the saving habit is to set up a savings plan that includes a Pre-Authorized Chequing (PAC) plan. Then every month or two weeks, as you prefer, a certain amount of money goes from your bank account to your choice of registered investment. Compared to making one large contribution to your TFSA or RRSP near the annual tax deadline, the PAC route is relatively pain-free. Just create a periodic purchase plan that enables you effortlessly to invest throughout the year.

Here are some of the key benefits of a PAC:

Dollar-cost averaging

When planning for your retirement – or any other savings plan, for that matter – the investment you choose should be in line with your time horizon and risk preference. One way to reduce your risk without having to alter your investment choice is through the dollar-cost averaging effect of a PAC. In the short term, volatility is unavoidable; the best way to reduce the effects of this volatility is to refrain from trying to time the market. By setting up a PAC, you are able to mitigate the effect of fluctuation on your financial portfolio. And by setting up a PAC on a per-month or bi-weekly basis, you are now purchasing units of specific investment products through the short-term rise and fall of the share price. Simply put, the more frequently you set up your PAC to occur, the less the risk to your portfolio: You will continue to buy units during both the upswings and downturns of the market.

It was Ben Graham2 who discovered this key strategy for helping smooth out the negative short-term effects of marketplace volatility. A major influence in the investing success of high-powered business magnate Warren Buffett, Graham has written acclaimed books such as Security Analysis (1934) and The Intelligent Investor (1949).

Peace of mind and convenience

As discussed before, a PAC can be set up to a frequency of your preference, often to coincide with your paycheque. And we’ve noted that a PAC is a great way to establish saving as a habit – thereby removing the stress of a single, annual, all-at-once contribution at the RRSP deadline. By aligning the PAC with your incoming pay, you save first and spend second!

An automatic deposit into your investment account spares you the hassle of manually making the contribution. You are also able to enjoy peace of mind. Thanks to the principles of dollar-cost averaging, you will never have to worry about trying to “time the market,” that is, attempting to buy during the market’s short-term downturns. Timing the market can sometimes be profitable, sure. But as a strategy it’s difficult and risky, a game of luck. By contrast, a PAC plan relieves tension and gains you the many hours you would otherwise spend analyzing numbers and hoping against the odds you will get the process right. Don’t gamble with your life savings – guarantee them!

HINTS FOR BECOMING A GOOD SAVER

Meet with an advisor

From what I have noticed, both in conversations with friends and my work in the banking industry, some people avoid speaking to an advisor about their finances. The main reason is, I suspect, that we human beings are creatures of habit. We do not like to step out of our comfort zones. Discussing our finances with a professional is outside the zone of what many find comfortable. It takes that first meeting with a professional to reassure us – to get us into the consulting habit.

Don’t wait. Start now!

Let’s assume an annual rate of 5%, with a PAC plan of $250 on the first of every month. That adds up to $3,000 in total contributions a year. And that could result in $208,065 of pre-tax assets after 30 years of investing in an RRSP. Compare this to a once-yearly deposit before the RRSP contribution deadline. Assume the same annual return. The yield could be $199,317 after 30 years of pre-tax assets in an RRSP. That difference of $8,648 is one more power that you hold through the use of a PAC plan. You are able to accrue a return on the funds from the moment they are invested, rather than waiting until the end of the year and missing the opportunity to invest increments throughout the year.

Compound interest

The most effective tool in the world of investing is compound interest over the lifetime of the investment. If you already have a PAC plan set up, and find you are accumulating contribution room in your RRSP or TFSA, it may be time to look at your budget and increase your PAC amounts.

Maxed out on registered accounts?

If you are maxed out on registered accounts, consider setting up a monthly PAC plan of $450 a month or $225 bi-weekly. The money can go to a TFSA to take advantage of the yearly $5,500 limit. You won’t have to worry about over-contributing or trying to time the market – again, a risky endeavour – with a lump-sum investment.

Conclusion: Now is your opportunity

If you are still making lump-sum contributions to your registered accounts, now is your PAC opportunity! Get in touch with your financial advisor to take advantage of the benefits Analystd with setting up a PAC plan.

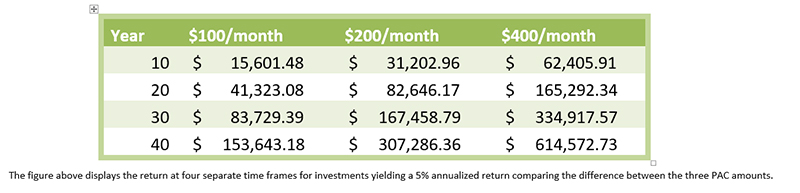

Maybe you already employ a PAC as a feature in your saving strategy. The time may be also opportune for you. Look at the PAC amount you have set up. See if there is a fit within your budget to begin increasing this amount. An increase of $100, say, might not seem substantial. But even $100, broken down to about $3.40 per day, has powerful implications over the long run. As shown in the table, an increase to an existing PAC can yield exponentially tremendous results in the future.

If you gain just one insight from my article, I hope it is this: In addition to the right investment product selected by your financial advisor, the key to meeting your financial goals is by saving. And there is no better way to take action on saving than by setting up a PAC plan with your investments – and reaping the benefits of the resulting, ever-growing pool of funds.

If a PAC is something you would like to learn more about, or if you have any questions or concerns as to your existing PAC plan, please do not hesitate to contact the Ciccone-McKay team at (604) 688-5262.

Supplementary reading

- http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/ind01/l3_3868_2180-eng.htm?hili_none1-- Statistics Canada information on Canadians’ saving habits

- http://www.cbc.ca/news/business/savings-decline-canada-1.3403923 – CBC News story on declining Canadian Saving Rates

- http://www.forbes.com/2009/02/23/graham-buffett-value-personal-finance_benjamin_graham.html2 Benjamin Graham on savings, investing and dollar-cost averaging

- http://www.ibmco.ca/rbcapril27emailsite.html – RBC on PAC benefits.

By Steven Bicego, B.Comm | Insurance and Investment Advisor

By Steven Bicego, B.Comm | Insurance and Investment Advisor