Beware the traps of emotional investing: Stay successful by staying big-picture

As an investor, you probably remember the how-to rules when you first started investing. Buy low, sell high. Diversify. Invest for retirement. Save before you spend. And you’ve adhered to these rules completely. Or…have you? The problem we often see with clients is an all-too-human one: their tendency to rely on emotions – and make unsound financial decisions as a result.

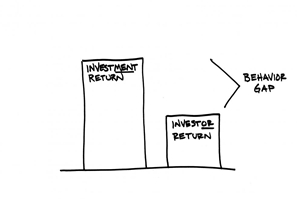

Known, not surprisingly, as emotional investing, this tendency occurs especially in times of market volatility. The key to stopping unwise, emotion-based decisions in their tracks is to understand why they’re happening. Such understanding is imperative to ensure the continued overall good performance of your investment portfolio.

In this article, we’ll look at two common kinds of emotional investing – and how to avoid falling prey to them.

Recency bias

Recency bias is our natural inclination to base decisions on recent events. In bull markets, this translates to a desire to own what has recently performed well. We observe trends and recent patterns; intuitively we decide that these will continue to be positive going forward. Recency bias clouds certain of our conclusions, decisions and actions – and can be particularly dangerous during periods of rising markets. In a lengthy bull market, as we are in now, the bias leads unwary investors into a false sense of security. They believe markets will just continue to go up. The frequent outcome: They purchase an investment that has enjoyed the bulk of its growth. Essentially, these investors are buying high.

Conversely, recency bias can cause people to react in the opposite way when experiencing adverse events. As we saw in 2008, many investors liquidated their entire portfolios thinking the crash would continue. Too late, when global markets rebounded, those investors realized their error. Their losses were locked in. They bought back into markets – but at a much higher price.

You can see how recency bias may influence unsuspecting investors to do the opposite of the advisable buy low, sell high strategy. During volatile markets, it is essential to stick with your long-term investment strategy. Avoid assuming that recent events will continue as the norm.

The illusion-of-control bias

Then there’s the illusion-of-control bias. That’s where we as individuals may overestimate the extent that we can control our portfolio outcomes. It’s a bias common among main street investors, that is, small, independent investors. As with recency bias described above, control bias is an emotional trap. Those investors who fall into it tend to panic and make poor decisions on seeing declines in any aspect of their portfolios.

Feeling a loss of control, they try to regain it by jumping into action with an abrupt sale of assets. Short-term result: a sense of control. Long-term reality: loss of profits they could have made by riding out the temporarily-less-valuable stock.

Here’s what these control-obsessed investors get wrong. Successful portfolios are a combination of diverse asset classes. A healthy variety of asset classes includes some that are now and then not particularly in favour. That’s because investments tend to be cyclical. Therefore, well-diversified portfolios are negatively correlated, some asset portions go up, some trend down. Overall, the diversified portfolio keeps faring better. Savvy investors get that; they get the big picture. As a result, they don’t panic. They don’t make poor decisions.

Moral: Let go of the illusion-of-control bias. By having the discipline to trust your long-term strategy during negative times, will result in better outcomes.

To avoid emotional investing, think long-term

Here’s what we advise clients. To counter the natural – though unwise – knee-jerk reaction to this or that stock’s volatility, have a long-term strategy in place. Know that there will be ups and downs, but focus on your long-term personal goals and always keep that focus clear.

At Ciccone/McKay, we help clients reach their goals by first asking: What matters most to you? We build their investment process around two parts: solid financial planning and risk management. To us, these are inseparable mechanisms in achieving successful financial outcomes. By achieving this fundamental understanding with our clients, we help them achieve investment success.

What matters most in the end is meeting each client’s long-term goals, as opposed to chasing this or that stock’s temporary, ephemeral ups and downs. With our investment process, we start by taking a holistic view of each client’s personal finance. Acting for the long term is paramount for success – and therefore it is how we structure portfolios.

Our team of financial experts work to construct a lasting, solid, personalized blueprint that becomes a client’s foundational relationship with our firm. Our philosophy centres around understanding short-term fears while we emphasize meeting long-term needs. In this way, our investors can handle periodic volatility without leaving their investment plans – and falling into such destructive emotional traps as described above.