Q3 2024 Market Commentary: Where Political Noise Meets Economic Reality

Anthony Ciccone | CHFC | President at Ciccone McKay Financial Group

In this Q3 2024 Market Commentary, Matthew Mobilio, CFA, CFP, Portfolio Manager at Louisbourg Investment Inc., explores political dynamics, interest rate changes, and broader economic trends intertwine, reminding investors that while elections may create headlines, it's the underlying market fundamentals that truly impact your finances.

Political discussions have recently taken center stage in both Canada and the U.S., raising concerns about their potential effects on the markets. However, it's important to note that long-term market performance is primarily driven by factors such as corporate earnings, economic growth, and global influences, rather than short-term political events. Central banks, including the Bank of Canada and the U.S. Federal Reserve, have played a significant role in combating economic slowdowns by cutting interest rates.

Meanwhile, the reinvestment risk of cash instruments has become apparent amidst market shifts, with equity markets outpacing returns from cash-based investments. Furthermore, Canada's inflation rate has dropped to 2.0%, leading to potential challenges for Canadians with mortgages coming up for renewal as interest rates may not see a dramatic drop in the near future.

Matthew Mobilio | CFA, CFP | Louisbourg Investments | Portfolio Manager

In recent months, political debates have taken center stage in Canada and the U.S., with Trudeau and Poilievre facing off north of the border, while Trump and Kamala Harris spar in the States. Regardless of where you land politically, these events raise a crucial question: what impact do elections have on the markets? It’s a question I’ve been asked many times recently.

But politics is only part of the conversation. Clients are also concerned about the economy—whether a crash is looming, what is happening with Canadian real estate, and my views on interest rates. There has been a lot to unpack this past quarter. The Bank of Canada (BoC) continues to lower its policy rate, and the U.S. Federal Reserve has shifted course, cutting rates as well.

So, what does this all mean for your portfolio? Let me share what my team and I are seeing in today’s environment.

Elections and the Market:

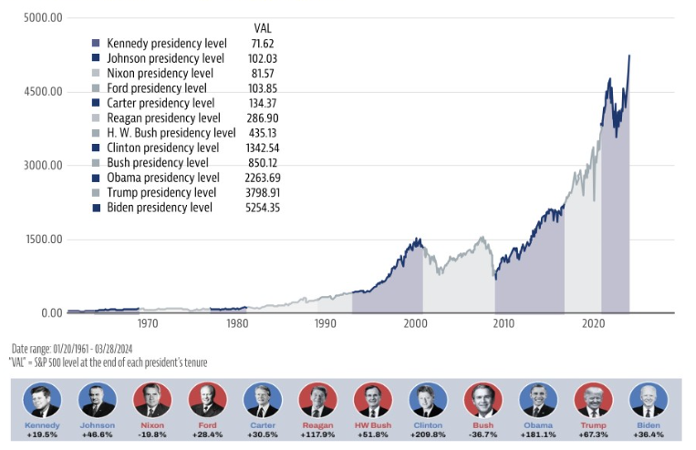

The influence of elections on the stock market is often exaggerated. While policies whether tax cuts, regulation, or trade agreements can cause short-term market swings, long-term market performance is usually driven by deeper forces like corporate earnings, economic growth, and global factors. Regardless of whether a Democrat or Republican sits in the Oval Office, or which party is in power in Canada, the market’s trajectory is shaped more by fundamentals such as interest rates, inflation, and technological innovation. Below is a chart that shows the SP500, and which president was in power and the corresponding political party:

In fact, monetary policy from central banks, like the Federal Reserve, tends to have a greater influence on the S&P 500 than any individual president’s actions. Historically, the market has performed well under both Democratic and Republican leadership, showing that it is the broader economic forces at play, not necessarily who is in charge politically.

Central Banks and Rate Cuts:

Between the start of July and the end of September 2024, both the Bank of Canada and the U.S. Federal Reserve took steps to combat economic slowdowns by cutting interest rates. The BoC reduced its benchmark rate by 25 basis points, citing concerns over weakening domestic demand and a cooling real estate market. The Federal Reserve, facing a similar situation, cut rates by 50 basis points as inflation slowed and economic activity softened. These moves were meant to support the economy, signaling growing recession risks in both countries.

The Reinvestment Risk of Cash

Every weekday morning, I start my day with a 5 a.m. call with our team in Atlantic Canada, followed by an hour-long workout. Then, I make my way to the office in downtown Vancouver. After parking, I walk about 100 meters across the street toward my office building. On the way, I pass a sign from the bank branch located on the main floor of our building. This sign shows their GIC annual rates they are offering. Over the last three months, I have watched that rate drop weekly from 5.30% to today’s 4.15% annual rate and I suspect more declines to come. It is a subtle reminder: the reinvestment risk of cash instruments. This risk becomes clear when you look at the broader market. The Canadian market is up 15% year-to-date, while the S&P 500 has surged 20% YTD. Holding too much cash, even in something seemingly safe like a GIC, can lead to missed opportunities as equity markets outpace returns from cash-based investments.

These shifts in policy, economic concerns, and market movements have real implications. By keeping an eye on the bigger picture, we can help ensure your portfolio is positioned to weather both the short-term fluctuations and long-term trends that lie ahead.

Mortgage Rates in Canada:

After staying above target for more than three years, Canada's inflation rate finally dropped to 2.0% in August. The job market weakened, as unemployment rose to 6.6% in August due to strong population growth. At the same time, elevated interest rates drove the household debt service ratio to record highs. Many Canadians may face further challenges as mortgages taken out during the pandemic at ultra-low rates come up for renewal in the coming months.

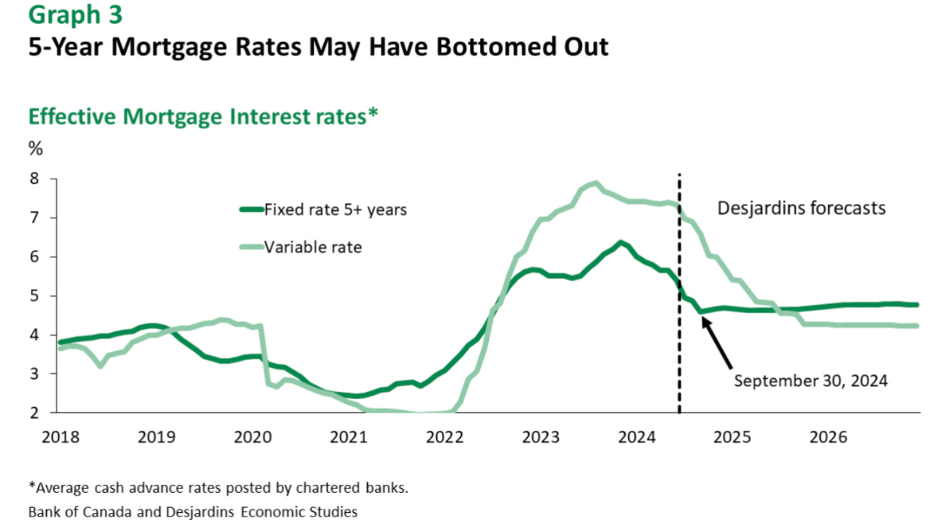

When talking to anyone looking to buy a new home or renew their mortgage, you often hear the same hopeful refrain: "I’ll wait for the rates to come down." However, as I was reading a note from Desjardins Economics, they captured the situation best:

“Anyone hoping for a dramatic drop in retail rates may be disappointed. Based on our observations, 5‑year fixed mortgage rates have already fallen more than 170 basis points compared to their recent peak. In fact, they could even start edging back up in 2025 as the outlook for the Canadian economy improves. Variable rates will come down in proportion to policy rate cuts. But given their significantly higher starting point, variable rates probably won't end more than 50 points lower than the current 5‑year fixed rate even when the policy rate reaches its anticipated low of 2.25% (graph 3). The reason is simple: since the BoC's policy rate cuts have been widely anticipated, the reductions have already been priced into fixed mortgage rates.”

Overall, with the backdrop and what’s happened over the last quarter we continue to monitor the portfolios and actively trade within our funds to jump on opportunities within our book. As our quarterly commentary on the funds, you will see we have made meaningful changes to the portfolio as a whole and continue to move forward in this market environment.

Please feel free to reach out to myself or the team.

Author:

Matthew Mobilio, CFA, CFP

Louisbourg Investments Inc., Portfolio Manager

As always, for more information about Ciccone-McKay Financial Group, or if you want to chat with someone at the firm, we welcome your call: 604-688-5262.