Q4 2024 Market Commentary: Year in Review

Anthony Ciccone | CHFC | President at Ciccone McKay Financial Group

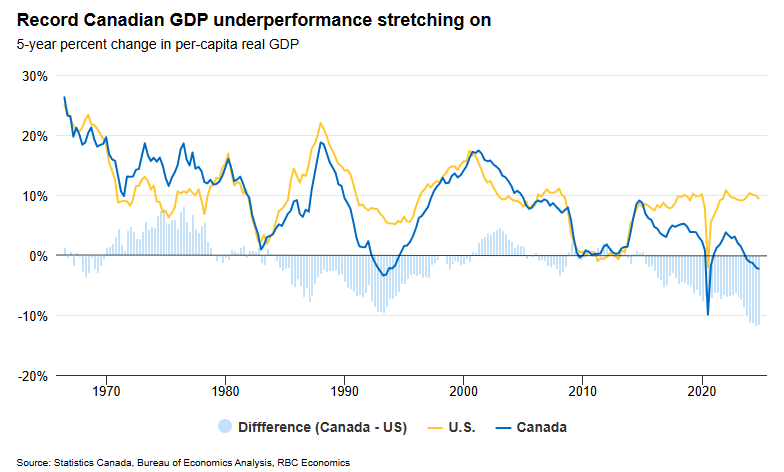

As we reflect on 2024, global economic dynamics have been shaped by significant monetary policy shifts, evolving political landscapes, and market adjustments. The Federal Reserve took a measured approach to rate cuts, balancing inflation concerns with sustained economic growth. In contrast, the Bank of Canada acted more decisively, implementing deeper cuts to counteract slowing economic momentum. Canada continues to grapple with productivity challenges, which have widened the GDP per capita gap between our economy and that of the U.S. Structural inefficiencies, high taxes, and regulatory hurdles remain key factors impacting our long-term growth potential.

Meanwhile, the re-election of Donald Trump in the U.S. has signalled a shift toward protectionist policies that could influence trade, fiscal policy, and market stability. Additionally, global markets experienced heightened volatility in response to monetary adjustments, including the unwinding of the carry trade.

As we step into 2025, these factors underscore the importance of a well-structured investment strategy that aligns with long-term financial objectives. Our team remains committed to monitoring these developments and ensuring that your portfolio is positioned to navigate risks and capitalize on emerging opportunities.

For a more in-depth analysis, we encourage you to read Matthew Mobilio’s (Portfolio Manager at Louisbourg Investments) Market Commentary below, where he explores deeper into the key economic themes and market trends shaping the year ahead.

Key Planning Reminders for Early 2025:

- Registered Retirement Savings Plan (RRSP) contributions: Deadline is March 3, 2025.

- 2025 Tax-Free Savings Account (TFSA) contribution limit: You can add up to $7,000.

If you have any questions or would like to discuss how these market developments impact your financial strategy, please reach out via email at info@ciccone-mckay.com or by phone at (604) 688-5262. We’re here to help you navigate the opportunities and challenges ahead. Wishing you a prosperous and successful 2025!

Matthew Mobilio | CFA, CFP | Louisbourg Investments | Portfolio Manager

As we start a new year, let’s take this opportunity to reflect back on the last one. 2024 had significant financial developments and economic transitions. Both the Bank of Canada and the U.S. Federal Reserve shifted their monetary policies toward easing as economic conditions evolved, signalling a coordinated global response to slowing growth and easing inflationary pressures.

Key economic themes of 2024

Monetary policy shifts

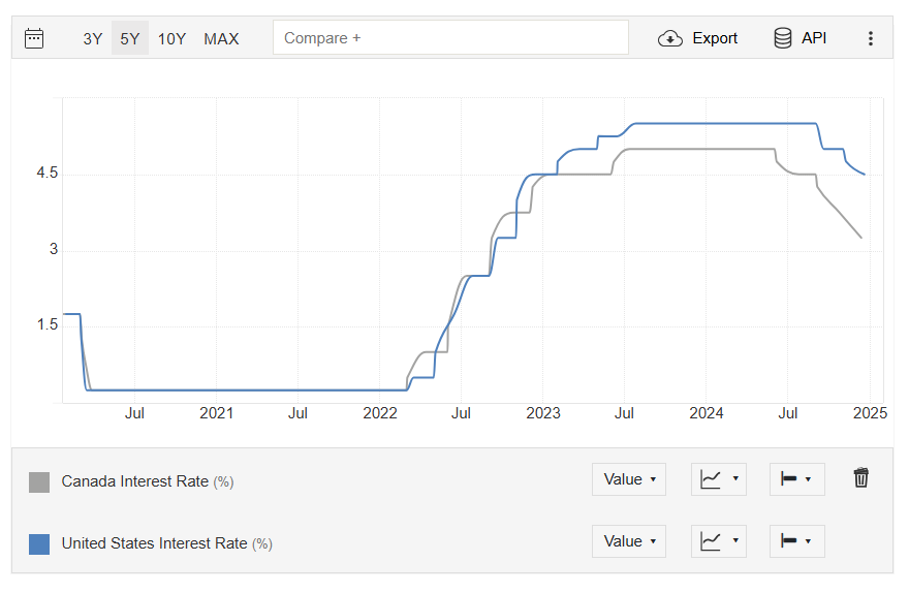

The Fed’s rate cuts were more gradual, reflecting a need to balance U.S. economic growth with inflation control in a relatively robust economy. Inflation pressures persisted longer, particularly in the services sector, necessitating a more cautious approach to easing.

By contrast, the Bank of Canada’s (BoC) more aggressive cuts aimed to support a slowing economy and ease pressure on indebted households. The BoC made deeper cuts due to inflation pressures in Canada moderating more quickly, a result of weaker domestic demand and declining energy prices.

*Source: Trading Economics

The Bank of Canada’s series of rate cuts totalled 175 basis points, reducing its policy rate from 5.00% in June to 3.25% by December. The BoC spaced the cuts out over the key dates of June 5, July 12, September 4, October 23 and December 11, a measured but proactive approach to fostering economic stability.

Similarly, the U.S. Fed reduced its federal funds rate by 100 basis points in the latter half of the year. Starting with a 50-basis-point cut in September, followed by 25-basis-point reductions in November and December, the Fed adjusted its target range from 5.25 to 5.50%, making it instead 4.25 to 4.50%.

These monetary policy shifts reflect central banks’ shared objectives of mitigating recession risks and stabilizing inflation within their respective economies, amidst global uncertainties and signs of cooling demand.

Economic growth:

The U.S. economy showed resilience in 2024, supported by strong consumer spending and technological innovation. Canada, on the other hand, faced challenges from weaker global demand for commodities, high household debt and a cooling housing market.

The Canadian and U.S. economies, while closely interconnected, have key structural differences that influence their monetary policies and economic trajectories. These differences were especially noticeable through the second half of 2024. The differences stem from variations in the two countries’ economic composition, housing markets, trade dynamics and fiscal policies, leading to divergent paths in economic performance and monetary responses. As we have seen, this also caused a larger divergence in the USD/CAD exchange rate.

High household debt levels and a housing market that plays an outsized role in the economy make Canada more sensitive to interest rate changes. Rate cuts may improve the outlook – but may not budge as much for mortgage rates. The core issue with Canada is, in fact, productivity. Gross Domestic Product (GDP) per capita compared to our southern neighbours has widened since 2019:

Figure 1: RBC Economics

Compared to other open economies, such as in Organization for Economic Cooperation and Development (OECD) countries, Canada is also for the most part underperforming. Our GDP per person has declined in the post-pandemic period.

Why? Keeping it simple, I’ll explain some of the key issues involved. Economic growth comes from people and productivity. Canada’s productivity has been masked by rapid population growth over the past few years. But, when we peel back the onion layers, we see that our output per worker has been falling. Here are some of the factors affecting our productivity:

- Weak business investment: The added layers of permitting at the federal, provincial and municipal levels make business investing very inefficient for investors. Which, of course, makes Canada challenging to do business in. Case in point: The Trans Mountain pipeline, though now up and running and adding to our GDP growth on an annual basis, took 10+ years to complete. In other words, the project took a decade’s worth of money!

- Higher taxes: We pay some of the highest taxes for individuals. This inevitably leads to brain drain, i.e., talent and capital leaving Canada – a disincentive for entrepreneurs.

- Bigger government: Not an ideal set-up for the private sector. As the government expands, it takes workers out of the private sector pool. The result: A higher percentage of the economy gets spent on government. Yet government jobs bring no productivity growth compared to the private sector, which does have productivity growth.

These factors contribute to our productivity challenges, especially when compared to our robust neighbour to the south.

Potential solutions could involve implementing targeted changes, such as:

- Transitioning to a more efficient government structure.

- Streamlining permitting processes to reduce delays.

- Lowering individual tax rates to encourage investment and innovation.

These policy changes, combined with effective monetary strategies from the central bank, could lay the foundation for a stronger and more productive economy.

Political and policy developments: The Trump presidential victory

The re-election of Donald Trump in the U.S. has brought a first wave of the potential “America First” policy shifts he promised to impose. Here are some key ones:

1. Trade and Economy:

Impose tariffs and reduce corporate and income taxes.

2. Immigration:

Implement what Trump calls the “largest deportation program in American history.” Also: increase funding for the U.S.-Mexico border wall; and dismantle the Department of Homeland Security, in favour of creating a larger border policing operation.

3. Government reform:

Establish an “external revenue service” to collect tariffs and foreign revenue. Eliminate job protections for thousands of government employees. Place independent agencies under direct presidential control.

4. Deregulation:

Implement a comprehensive deregulation initiative. Trump’s deregulation strategy has been a cornerstone of his economic policy. He promises to boost job creation, increase household incomes and reduce compliance costs for businesses.

5. Energy and environment:

Reverse former president Joe Biden’s ban on offshore drilling. Abolish Biden’s electric vehicle mandate. Slash federal funding for renewable energy research.

As I’ve noted in previous Quarterly Notes, all the above will have implications for the CAD/USD exchange rate. Once Trump assumed the presidency on January 20, a series of policy changes began, signalling the election promises he’s moving on.

Markets and carry trade unwinding

Why is this important? In July the Bank of Japan significantly shifted Japan’s monetary policy by raising rates. The U.S. Fed was already on the path to reduce rates, due to fears of recession leading to the dollar weakening and the yen appreciating. With the yen increasing against the USD and other currencies, there was significant unwinding of the carry trade. Put simply, carry trade occurs when an investor borrows money in a low-interest-rate country and invests those proceeds in a higher-interest-rate country. The result of this in 2024: more volatility, triggering a sell-off across global markets. This, in turn, affected not only currencies but equities and other assets.

To explain further, let’s look deeper at the U.S. and Japan example:

- The trader borrows 1,000,000 JPY at 0.5% interest.

- The trader converts it to USD at 100 JPY/USD, getting $10,000 USD.

- After a year, the trader earns 4% on $10,000, which is $400.

The profit is then made up of the following:

- The interest on the JPY loan is 0.5% of 1,000,000 JPY = 5,000 JPY.

- To repay this in USD, we need to convert at the current exchange rate (assuming it's still 100 JPY/USD).

- 5,000 JPY / 100 = $50 USD.

So, the trader would need to pay $50 USD equivalent to cover the interest on the JPY loan. The profit calculation remains the same: $400 - $50 = $350 USD. However, it’s crucial to note that this profit is subject to exchange-rate risk. If the JPY strengthens against the USD when it’s time to repay the loan, the profit could be reduced or even turn into a loss.

In this simple example, we’ve used small numbers. But when billions of dollars are moving and the trade begins to work against investors, it creates volatility. What happened in 2024 was that, for a short-time, the volatility rocked markets. So much so, in fact, that the Bank of Japan needed to alter its monetary policy plan.

Looking ahead

The events of 2024 underscore the importance of maintaining a diversified and resilient investment strategy. As markets adjust to evolving monetary policies, economic shifts and political developments, our focus remains on aligning your portfolios with your long-term financial goals.

For the first time in about 15 years, central banks have more flexibility to adjust their policies. We continue to monitor these trends and adjust our strategies to navigate risks and seize opportunities.

Mat Roy, our Head Equity Portfolio Manager, has a quarterly commentary on the Louisbourg Investment front. You’re welcome to read it by clicking here.

Key reminders for the beginning of 2025:

- Registered Retirement Savings Plan (RRSP) contributions: DEADLINE IS MARCH 3, 2025.

- 2024 RRSP contribution limit: 18% of earned income from the previous year, up to a max of $31,560.

- 2025 RRSP contribution limit: 18% of earned income from the previous year, up to max a of $32,490.

- To check on the RRSP amount you’re allowed to contribute, go online to My CRA and to Notice of Assessment. Also, talk with your tax professional.

- 2025 Tax Free Savings Account (TFSA) contribution: You can add up to $7,000.

Should you have any questions or wish to discuss your portfolio in greater detail, please do not hesitate to reach out.

Warm regards, and all the best for 2025!

Author:

Matthew Mobilio, CFA, CFP

Louisbourg Investments Inc., Portfolio Manager

SOURCES:

RBC Thought Leadership. (n.d.). Canada’s growth prospects brighten in 2025—but not without challenges. Retrieved January 28, 2025, from https://thoughtleadership.rbc.com/canadas-growth-prospects-brighten-in-2025-but-not-without-challenges/

As always, for more information about Ciccone-McKay Financial Group, or if you want to chat with someone at the firm, we welcome your call: 604-688-5262.