Market Commentary

February 06, 2026

Year-End Report: Amid tumult, discipline — as always — held the course

As we close the chapter on 2025, it’s clear this was a year defined by volatility, transition and resilience. Markets faced shifting tariff policies, evolving central bank decisions, slowing economic momentum and highly concentrated leadership among a handful of mega-cap companies. Through all these challenges, one principle stood firm: Discipline and diversification matter more than prediction.

In this Year-End Report, I reflect on the key themes of 2025, explore structural challenges facing Canada and outline what investors should expect as we head into 2026.

The year began with geopolitical uncertainty and renewed tariff concerns. Disrupting long-held, mutually positive sentiments, these forced both Canada and the U.S. to navigate a more complicated economic landscape. In response to softer confidence and trade-related risks, the Bank of Canada cut interest rates early in the year, a move aimed at supporting households and stabilizing growth.

Despite all the noise, we at Louisbourg remained focused on fundamentals — and used the volatility to reinforce high-quality positions.

Q2 opened with turbulence after the U.S. announced its “Liberation Day,” i.e., floating reciprocal tariffs that sent markets sharply lower. But the pullback didn’t last. By quarter’s end, both the S&P 500 and the TSX had rebounded to near-record highs, supported by strong earnings, easing rate concerns and sector strength in tech, consumer stocks and Canadian metals.

The quarter’s swings were a reminder of a principle I emphasize often: It’s not about timing the market — it’s about time in the market. Just like my annual GranFondo ride at Whistler, the easy downhill part isn’t where the real work happens. Rather, it’s the long climb where discipline and preparation matter most. Markets can behave the same way: The difficult stretches test investors, but staying committed is what gets you to the top.

History supports this. Over the last 25 years, missing just the 10 best days in the S&P 500 was enough to cut annual returns by more than 3%. Missing the 40 best days pushed returns negative. But when you extend your holding period across stocks, bonds or a balanced portfolio, volatility shrinks and outcomes stabilize.

I’ve seen investors move to cash during volatility, planning to “get back in later” — only to miss the recovery’s strongest days. Those moments often define long term performance.

The message from Q2 is clear: Stay invested, stay disciplined — and let time, not timing, do the heavy lifting.

2025’s third quarter marked a meaningful shift in the economic cycle. Both the Bank of Canada and the U.S. Federal Reserve began cutting rates by 25 basis points (BPS), acknowledging softer inflation and slowing momentum. But, as policy eased, strain was building. Delinquencies rose across Canada, with the labour market softening and the housing market showing clear signs of fatigue. After years of resilience, households were, and still are, feeling the weight of higher borrowing costs.

Like my annual Whistler GranFondo, the first half of the year felt like the perfect parallel: smooth sections later giving way to steeper, more demanding terrain. As with long-distance riding, this part of the cycle is where discipline matters most. Stay diversified, maintain liquidity and avoid overconfidence in less liquid assets.

Liquidity risk was definitely a theme in Q3. Yes, alternative assets like private real estate and private equity can play a valuable role — but their “smoothing” effect can understate volatility and create challenges when capital is needed most. A modest allocation helps; overexposure becomes a risk.

The message from Q3: The climb has begun. Balance, diversification and liquidity discipline will be essential as the cycle continues to shift.

In Q4 2025, investment discussion in Canada, with close reference to the U.S., focused on a combination of easing monetary policy, resilient economic data and shifting market leadership. The Bank of Canada’s October rate cut, which lowered the policy interest rate to 2.25%, placed the overnight rate at the lower end of its estimated neutral range (2.25%-3.25%), suggesting that monetary policy had become relatively accommodative. And, that further cuts might be limited, absent significant economic deterioration.

Expectations for additional interest-rate adjustments by both the Bank of Canada and the U.S. Fed supported equity valuations and improved sentiment in rate-sensitive sectors such as financials and cyclicals.

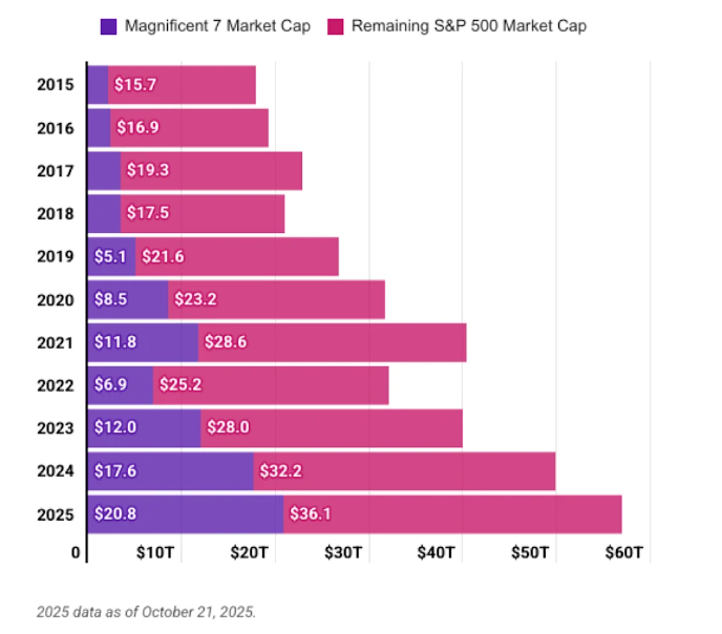

Corporate earnings remained a central driver. Strong results from Canada’s major banks and broad earnings resilience in the U.S. reinforced confidence that growth was extending beyond mega-cap technology — and prompted active dialogue around market breadth and diversification, rather than narrow leadership. On October 21, 2025, the so-called Magnificent 7 (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla) accounted for 37% of the S&P 500:

Across every quarter, one message endured: Preparation and consistency matter more than prediction. In navigating steep climbs, whether on the road or in the markets, the discipline of sticking to a well-built plan is what ultimately gets you to the summit.

With 2025 behind us, it’s worth stepping back and looking at everything we’ve discussed over the past 12 months. The themes that mattered in 2025 ended up defining the year as a whole: diversification, consistency, patience and the discipline to stay invested through the climbs, not just the smooth stretches.

2025 tested investors early and often. We started with volatility driven by geopolitical noise and tariff shocks, only to watch markets recover sharply. By mid year, both the Bank of Canada and the U.S. Fed had begun easing policy.

Again, the markets’ behaviour kept reminding me of my experience riding the Gran Fondo: the fast early descents, the gentle mid-section and then the long, demanding climb. In the market’s case, the daunting climb included rising delinquencies, a softer labour market, a weakening housing backdrop and the growing challenge of navigating an increasingly concentrated equity market dominated by a small handful of mega cap names.

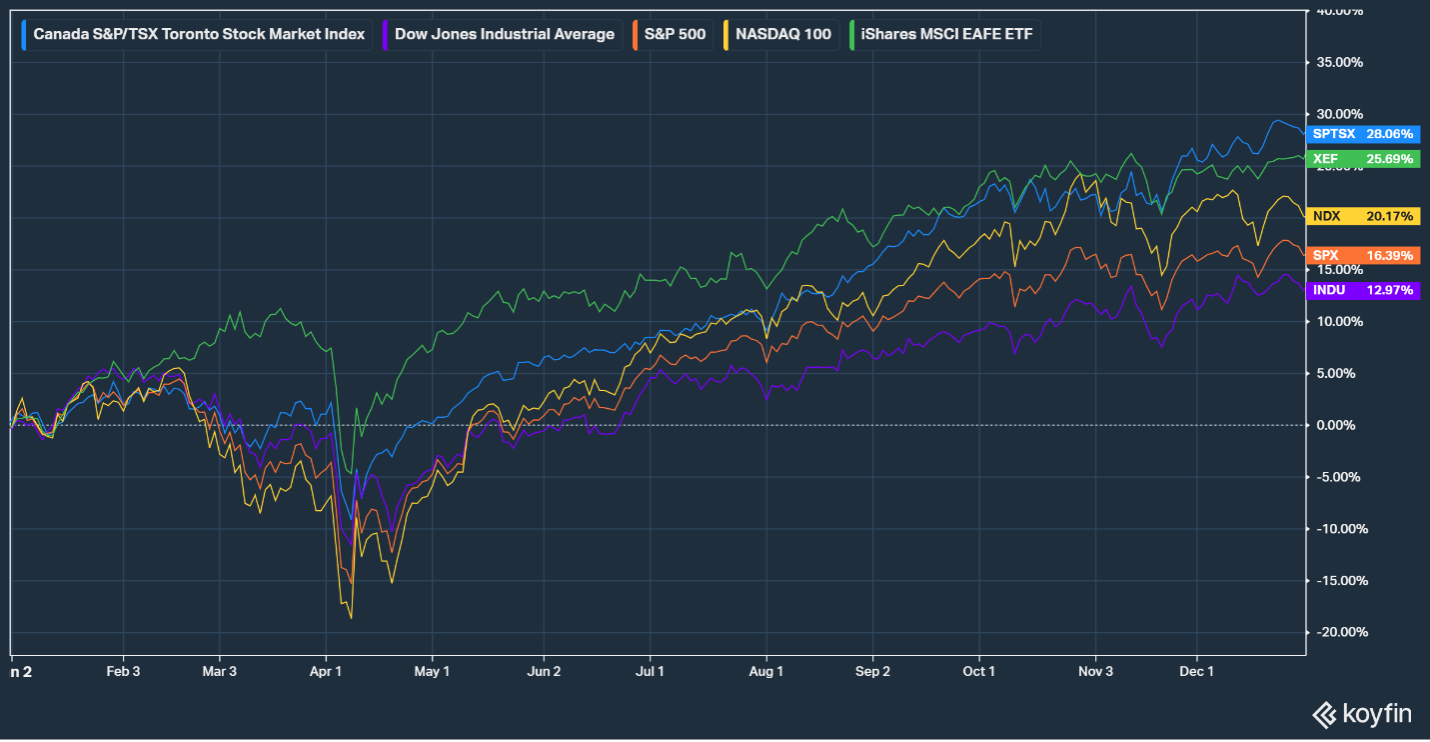

And yet, despite all that, chart below tells a remarkable story:

This chart shows what we’ve emphasized all year: There is no way to reliably predict which market will lead, which will lag or which will surprise. Canada finished at the top and the U.S., despite all the headlines and mega cap dominance, finished below.

This is geographic diversification working exactly as it’s meant to. It’s also time in the market doing what timing the market never will.

If you stepped aside during volatility, waiting for the “right moment,” you likely missed the strongest stretches of the year. If you chased what worked last year, you may have missed what worked this year. And, if you overleveraged into illiquid private investments, you may have been blindsided with gated redemptions and markdowns.

But if you stayed disciplined — balanced, diversified, patient — this year rewarded your approach. The world will always give us reasons to react. Yet time and again, the data — and the results — show that staying committed to a long-term plan is what compounds.

The RBC Forecast expands on many of the themes I’ve touched on in this report. The Canadian economy finds itself at a historic turning point. For the first time since the 1950s, Canada will experience a major reduction in population growth — a direct result of the government’s pivot on immigration policy.

This demographic shift entirely changes the growth narrative. A rising population will no longer buoy our gross domestic product (GDP). Instead, the focus will move to productivity and per-capita gains. After two years of declines, real per-capita GDP is expected to accelerate in 2026, supported by the central bank’s earlier easing cycle and a gradually improving labour market.

Inflation remains a delicate balancing act. While headline inflation, that is, raw inflation as reported in the Consumer Price Index (CPI), should hover near the Bank of Canada’s 2% target, core inflation will likely stay above it. For now, the Bank of Canada is expected to hold rates steady through 2026, with a modest tightening cycle anticipated in 2027 as the output gap closes and inflation proves sticky.

Meanwhile, the U.S. economy continues to surprise. Despite a softening labour market and rising unemployment — expected to peak at 4.6% in early 2026 — GDP growth has been revised higher to 2.4% for the year. Strong consumer demand and an improving trade balance have offset headwinds from last year’s government shutdown.

Inflation, however, remains a challenge. Core CPI is projected to hover around 3%, well above the Federal Reserve’s target, driven by tariff passthrough and housing-related components. The Fed is expected to keep rates unchanged at 3.5%-3.75% throughout 2026, balancing inflation concerns against slowing employment growth.

For investors, these dynamics underscore a critical theme: Structural trends matter more than headline numbers. In Canada, productivity-driven growth and stable monetary policy create opportunities in sectors tied to efficiency and innovation. In the U.S., resilient consumer spending and trade improvements support a cautiously optimistic outlook, even as inflation risks linger. Geopolitical uncertainty and tariff negotiations remain key downside risks, but the overall picture for 2026 is one of gradual normalization rather than disruption.

Key takeaways for investors:

- Diversification and discipline remain critical. Volatility will persist, but preparation matters more than prediction.

- Cash is not risk-free. As reinvestment risk can erode returns, stay invested in quality assets.

- Structural trends matter. Canada’s competitiveness challenge will shape long-term growth.

Closing thoughts

The events of 2025 underscore a timeless truth: Markets reward patience and preparation. Whether navigating steep climbs on the road or in the markets, the discipline to stick to a well-built plan is what ultimately gets you to the summit.