Avoid the tax drag on your investments with TFSAs

When it comes to investing, how much of the return you can keep at the end of the year is important for long-term investment outcomes. While asset allocation and investment selection are key components that affect your long-term returns, minimizing the tax burden and other costs are a sure-fire way of increasing your overall gain.

The good news is, without needing to illicit the services of tax professionals, one of the simplest ways to ensure you are maximizing the tax efficiency of your overall financial portfolio is to incorporate Tax-Free Savings Accounts (TFSA).

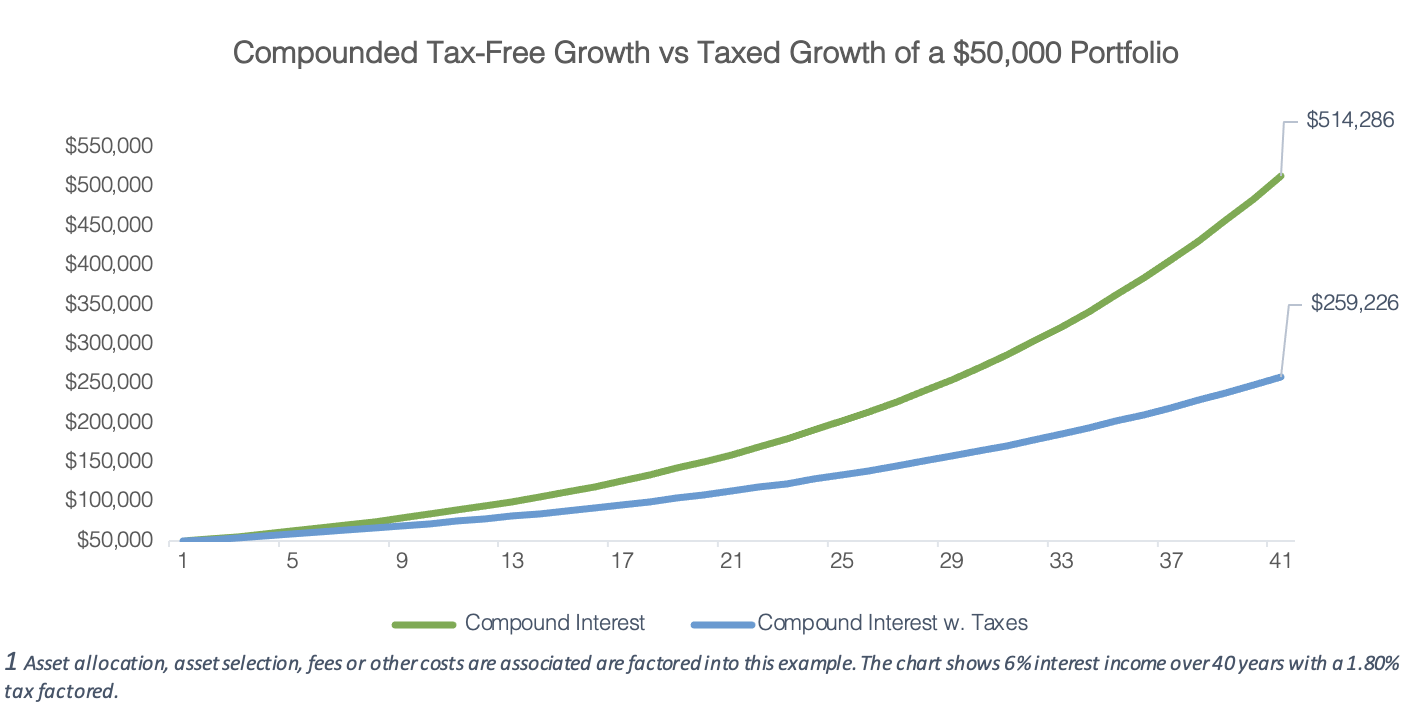

Tax-efficient growth is important because we only spend after-tax dollars. When it comes to investment-related taxes, the smallest amount can quickly add up over the years. It is important that the moves made to reduce the tax drag is considered. Looking at the chart below, we see a simple $50,000 portfolio earning 6% interest income. The green line shows the compounded return until year 41, and the blue line shows the compounded return as well; however, the blue line has a 1.80% of tax allotted (30% marginal tax bracket). The $245,060 difference in the two portfolios is due to the tax drag.

The best way to ensure taxes do not draw down your overall portfolio is to maximize your TFSA prior to investing your assets in taxable environments. Unlike other registered accounts that offer tax-deferral, the TFSA will always be tax-free and has no mandatory withdrawal age.

To keep more of your money earned, managing investments in a tax-efficient manner becomes critical. Tax mitigation techniques, like ensuring TFSA accounts are utilized, are accessible to everyone—simple planning goes a long way.

The TFSA is a great account for tax efficiency; however, it is only one part of the plan. If you want to learn more about TFSA’s or other registered account that will help establish tax-efficient savings and investment strategies contact us at 604-688-5262 or email at info@ciccone-mckay.com.