Corporate Owned Insurance - Why Now?

Life insurance plays an increasingly important role in financial planning due to the growing wealth of Canadians. Many affluent individuals use life insurance to protect their wealth against taxes arising on death. Others use exempt life insurance to provide retirement and other executive benefits. A valuable aspect of life insurance to fund the tax liability on company shares is the capital dividend account credits (CDA), it’s a notional account to flow tax-free receipts through to shareholders on a tax-free basis.

- A corporation that is the beneficiary of a life insurance policy will receive the death benefit free of tax.

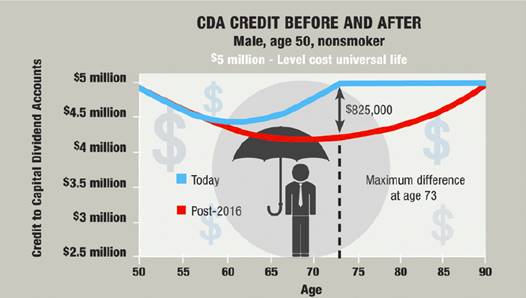

- The credits created are equal to the insurance proceeds less the policy’s Adjusted Cost Base (ACB).

- The credits allow corporations to efficiently transfer cash out to the shareholder’s estate on a tax-free basis.

The Capital Dividend Account (CDA) is a powerful tax-planning tool for people who own shares in private businesses.

BEST BEFORE 2017, new income tax rules for life insurance will come into effect in a little less than a year, with significant impact on estate plans. The new 2017 ACB calculations will result in higher ACBs for longer periods of time. This is primarily due to the updating of life insurance mortality tables taking into account current and longer life expectancies. The changes to the ACB may impact the amount of CDA credits available. This means less of the full death benefit will flow through the CDA to the estate if death occurs prior to life expectancy. The ACB will reach zero near life expectancy.

ACT NOW. Given the long-term planning that life insurance addresses, grandfathering is a critical aspect when changes are made. The new rules will offer grandfathering protection to policies issued before January 1st, 2017. Corporate strategies using permanent life insurance will continue to provide clients with advantages over non-registered investments.