Making sense of disability and critical illness insurance

We decided to write our next blog on disability and critical illness insurance. I volunteered to write this as I have experienced firsthand what it feels like to suddenly have your family faced with the unexpected loss of income due to disability. My family’s experience has made me a huge advocate for disability insurance. More on our story to follow…

The most misunderstood area of financial planning

When our firm begins the process of developing a comprehensive financial plan for an individual or family, most of the time, our clients bring up life insurance. They understand they probably need it, and they understand how it works (i.e. the death of the insured person means a payment to the beneficiary). Pretty simple.

In contrast, it is rare that either disability or critical illness insurance is first broached by a client. The phrase “disability is the most misunderstood area of financial planning” is tossed around our office a lot, and it’s very true! Some of the common misconceptions we hear are:

- It won’t happen to me.

- I would just live off my savings.

- I have coverage at work.

Most people fail to understand they are putting themselves at far greater risk by not insuring themselves against disability and illness, in contrast to death. They somehow feel that the impact of their death (financially speaking) would be far worse than the financial impact of being incapacitated.

The statistics that follow will show you why it’s essential to insure yourself with more than life insurance. But first, since we know it’s a misunderstood coverage, we’ll try to simplify how it works.

Living Benefits ... in contrast to death benefits.

Disability and Critical Illness insurance pay a benefit to the insured person, while they’re alive. This is why the industry has taken to calling these types of protection “living benefits.” To sum it up:

- Disability pays you a monthly benefit, designed to replace your income, in the event that you cannot work due to a severe illness or injury. The payments continue so long as you remain disabled, typically to age 65. Payments generally start after a 30-120 day waiting period.

In contrast:

- Critical Illness insurance pays a one-time lump sum amount, tax-free, based on the diagnosis of one of the insured illnesses or conditions. The funds can be used for anything and are typically paid 30-60 days after diagnosis.

The two protections go hand-in-hand. Both are designed to address the fact that with prolonged illness comes increased expenses, on top of the requirement to still pay your usual bills (mortgage, phone, groceries, car insurance) plus funding your retirement savings.

How they differ is what triggers the policy to pay the benefit.

For disability benefits, one typically needs to be unable to work. For most people, a severe injury or illness means a prolonged time away from work, and the need for continuing income.

In contrast, a critical illness policy pays a lump sum based on the diagnosis alone; it is not connected to your ability to continue working. For example, while you may be fighting something such as cancer or be diagnosed with a serious disease, you are able to continue working.

Isn’t it highly unlikely I will become ‘disabled’ or ‘critically ill’?

No, the stats on this are clear. Disability and severe prolonged illness occur much more frequently than one would think.

- 1 in 7 Canadians at any given time is disabled.*

- 40% of Canadians will have a disability lasting longer than 90 days before age 65.*

To understand this, you need to understand that ‘disabled’ is much broader than most realize.

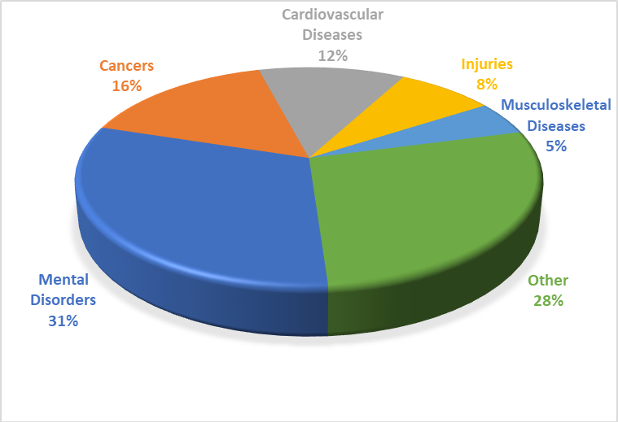

For example, 1/3 of claims are for mental illness, followed by cancer. I’m certain you know someone -likely in your inner circle- who has battled one of these. Most likely, they were unable to work for a period of time. When it comes to critical illness claims, cancer is the leading area of claim, followed by heart attacks and strokes.

- 2 in 5 Canadians will be diagnosed with cancer.*

- 90% of those experiencing heart attacks survive.*

As you can see, ‘disabled’ doesn’t mean critically injured, most of the time.

I have savings, isn’t this what they are for?

Having an emergency savings fund is part of a smart financial plan. But it’s not intended to replace your income over a long period of time. Consider this:

- The average duration of disability over 90 days, is 35 months*

Even if you have saved for retirement, would you want to tap into these funds to pay your bills?

Being forced to derail your retirement savings plans to cover essentials could mean years attempting to play catch-up, in order to still retire in the way you desire.

But what if you have coverage through work?

The key is to understand your coverage. How much do you have? Is the monthly cap set by the group plan much less than your earnings? How long does it continue to pay you, if something happens? How does the insurer define “disability” (i.e. would you need to be 100% completely incapacitated from doing ANY occupation to qualify?). In short, group plans are not customized to your needs, and rarely are the ideal solution on their own.

A disability is not a remote possibility. It can happen to you.

And finally, I have seen firsthand how important disability insurance is in keeping a family afloat! A devastating knee injury took my husband out of his job, first for a few months, then, when a series of surgeries lead to complications, he was unable to work in his industry for nearly 4 years as he struggled to move without pain. Without the monthly disability income, we would have been financially devastated. Instead, with disability income replacement, and despite extremely expensive medical bills and other increased costs, we kept on track with our mortgage, bills and even continued our long-term savings plans, rather than draining them.

For us, having disability insurance was the safety net we needed. We certainly didn’t think that at age 30, one of us would be unable to work and for that long. While we had savings, it wouldn’t have come close to covering 4 years’ worth of income.

We can help you to implement this important coverage.

If it’s been on your mind to look after this area of your risk management, please reach out to discuss your options. As always, we can be reached at 604-688-5262.

Sources:

Canada Life: https://www.canadalife.com/insurance/disability-insurance.html

https://www.canadalife.com/insurance/critical-illness-insurance/critical-illness-statistics-canada.html

https://www.canadalife.com/insurance/disability-insurance/disability-insurance-income-replacement.html

RBC Insurance https://www.rbcinsurance.com/salesresourcecentre/file-777224.pdf

Cancer.ca https://www.cancer.ca/en/cancer-information/cancer-101/cancer-statistics-at-a-glance/?region=on

Council for Disability https://disabilitycanhappen.org/overview/