Market Fears and Economic Signals

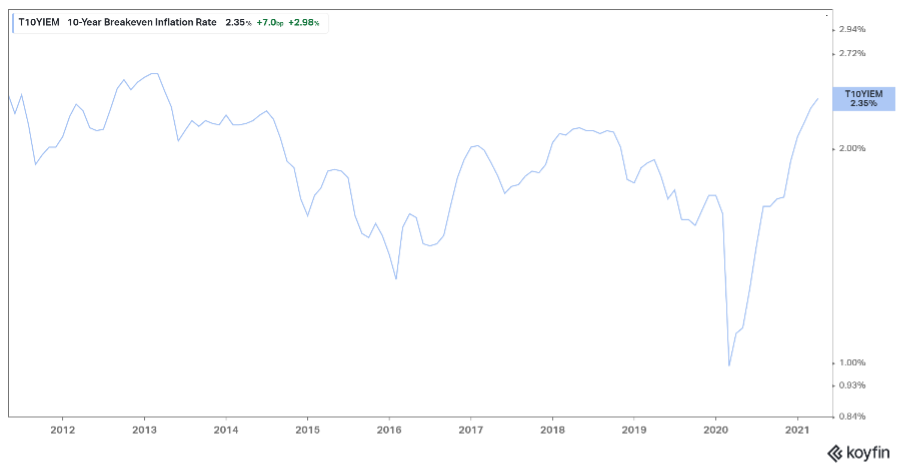

2021 is turning out to be a great year for equity investors. The market continues to hit new all-time highs after a strong recovery in 2020. However, inflation has picked up recently and is dampening investors’ enthusiasm.

As inflation expectations continue to gain momentum in the US and Canada, investors are afraid of runaway inflation which will cause the central banks to raise rates and shorten the strong recovery the economies are experiencing. Currently, the Feds stance is that the rising inflation is transitory due to disconnect between supply (covid) and demand (reopening). The Fed has a mixed track record on inflation and on numerous occasions has back tracked their statements.

If inflation continues to move higher over next 6 months, this could be concerning and as bond yields will start to test higher levels and also put pressure on equity markets. The large debt accumulated (public and private sectors) would compound at a faster pace. The credit markets could freeze causing a credit crunch and a recession could follow.

However, various segments of the economy are indicating the economy as a whole is in good shape. Normally, large market corrections are associated with recessions. Currently, there are no red flags from leading indicators warning of such an event:

-

Yield curve: One the primary instruments used to forecast the economic strength. The different between the 10-year and 1-year or the 10-year and 2-year Treasury yields have been good forecasters of a recession. The yield curve has turned negative before almost every recession as the spread between the long bond and short bond turns negative. Currently, the curve is steepening, forecasting a strengthening economy.

-

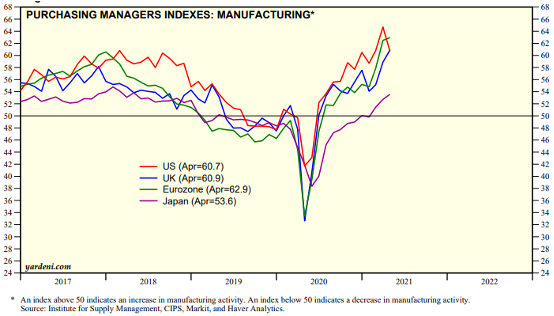

Manufacturing orders: PMI for Manufacturing is currently at a solid 60 in the US. A reading over 50 indicates increasing manufacturing activity and an expanding economy.

-

The stock market: Various indices such as the S&P 500, Nasdaq, TSX are all near their all-time highs, forecasting a strong and improving economy. Markets tend to look 6-12 months out; a rising market usually indicates a recession is not on the horizon.

-

Corporate credit spreads (difference between corporate bond yields and corresponding treasury yields) in the US remain near all-time tights. A sell off in the bond market usually precedes an economic drop off and raises the cost of borrowing from corporations.

Most of the market indicators mentioned above are supported by monetary and fiscal support. The stimulus in the economy continues to drive confidence and spending, incentivizing investors to riskier assets such as stocks and corporate bonds (driving them up) and away from treasuries (resulting in rising yields). This support also drives manufacturing activity and conviction that the economy will move higher.

The risk exists that this support gets taken away, but the Fed has made it clear that they do not intend to raise rates until second half of 2022 or first half of 2023. Congress has only recently implemented a new $1.9 Trillion dollar package to support the economy.

Investors should expect an increased level of volatility from equity and fixed income markets as the vaccine is rolled out and the economy begins to open. Further, US and Canadian equity markets are at their all-time highs with elevated valuations pricing in optimism, though they are supported by fiscal and monetary stimulus and low interest rates. All this means that investors need to lower their return expectations from equities and fixed income going forward.