Patience:

The investment lesson we can learn from golf

I love summertime for one reason—the golf season. Each summer my dad and I play a match on the course. Every year is different. One year could be match play, playing with internal games like presses; other years, simply just seeing who scores best. But, however different, all matches have something on the line. When I was younger and learning how to drive, we would play for driving privileges for the week. As I got older, the stakes increased, money has been paid, and dinner bought— generally by me. Nevertheless, our competition is something I look forward to each year.

Some of my earliest memories are of Dad coming home with trophies and other golfing merchandise from local golf tournaments. He was good, really good (and still is). For me, every round was more frustrating than the last. And the angrier I got at my game; the more Dad refused to let up. He would keep winning, hole after hole, year after year.

In the car ride home, like clockwork, he would say, “No matter how fast you play, golf takes four hours.” Or, “Good shot or bad shot, there are always more holes.” Or, “What’s wrong with the simple play?”

Another challenge of golfing with Dad is that he never shows emotion. He is always calm. He walks at the same steady pace. He never tries fancy shots; he only hits the shots he is confident in. If he ever did hit a bad shot, he would say, “Have to live with that result,” and move on. He never hurries, never succumbs to anger. And Dad always plays simple.

Looking back at all I learned on the golf course, I am amazed at how long it took me to grasp his secret –having patience. Here is the issue with my golf game over all those years. I had a short-term mindset. I focused on the big shot. I played fast and reckless, rather than slowing the process down, going through my routine and playing the high-percentage shot. I failed to keep in mind what Dad said, that there were more holes to go.

Golf is a long game. You are going to hit a bad shot, you are going to hit some good shots. Staying level-headed, not letting emotions cloud your judgement, doing what you’re good at: This is the recipe for compounded success. The same recipe holds true within your personal investment portfolio.

Looking back at the lesson I learned on the golf course, I only begin to realize all the synergies it has with investing.

Patient investing is the ability to slow the moment down and think long-term. For individual investors, a long-term horizon and patience are the ultimate key to long-term returns and wealth appreciation.

There are three reasons why patience is essential for investing.

Long-term investing puts the odds in your favour

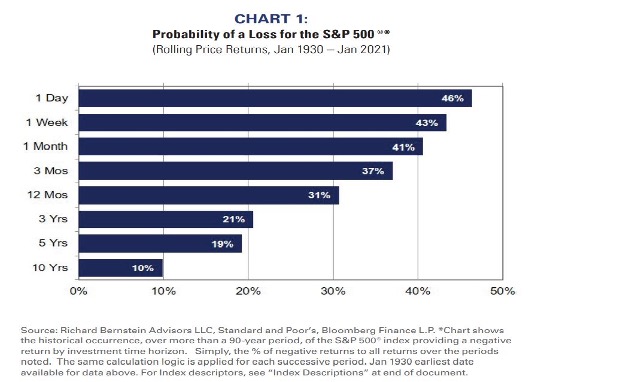

What would you say the probability of success is with day-trading? According to RBA Advisors, empirical data show that when you hold stocks for a day, the probability of success is 54/46. However, as your time horizon extends, the likelihood of losing money drastically decreases. Holding assets for one year reduces the likelihood of negative returns by 15% to 69/31. But, in holding assets for 10 years, there is now a 90% chance of positive returns — 90/10. Having the patience to extend the time horizon sets much better odds of investment success.

The chart above proves a valuable point. Diving in and out of investments, or investing short-term, is a risky gamble; investing for the long term removes the risk of lost opportunity.

The compound effect

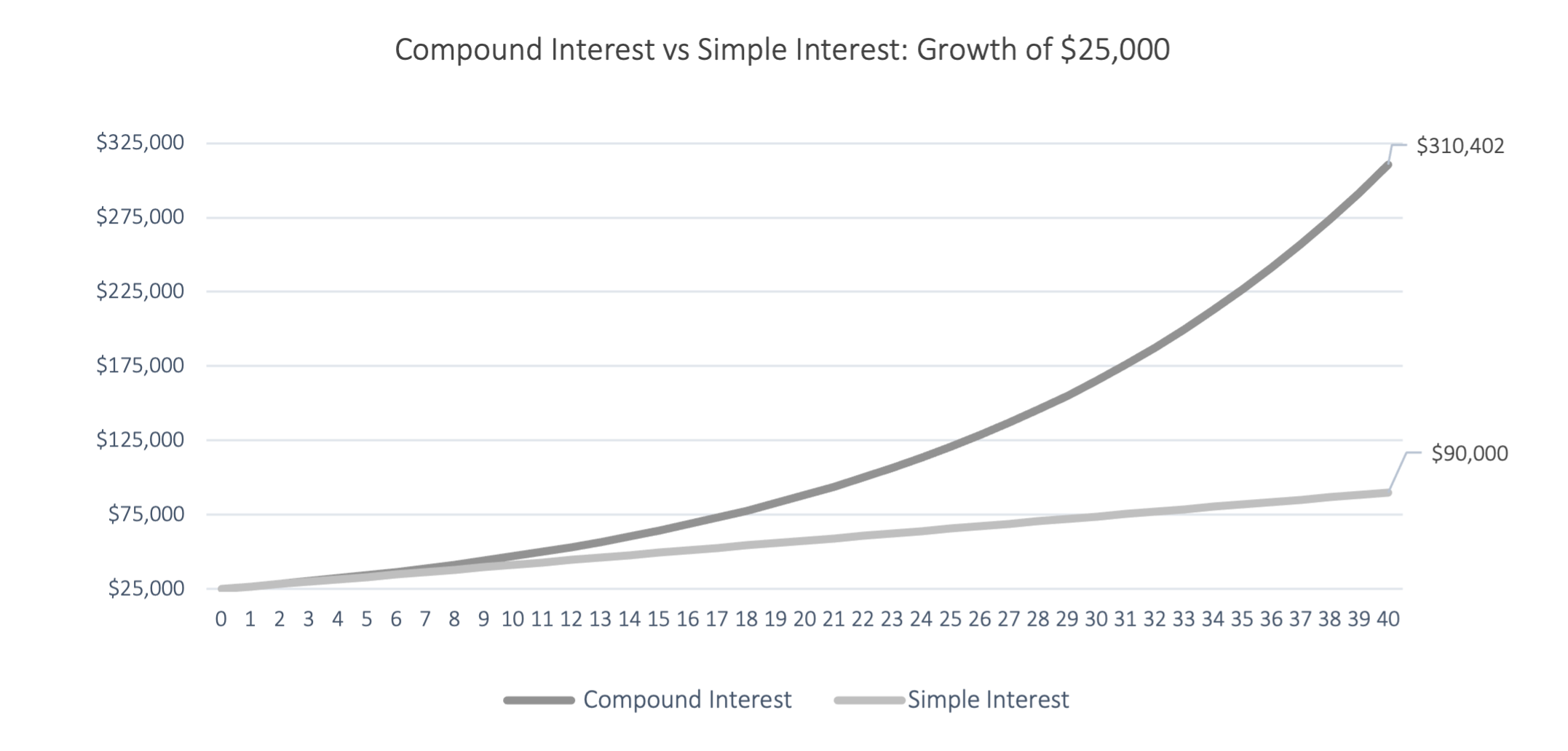

Time is your greatest ally when it comes to investing, for two reasons. First, as shown above, time reduces risk. Second, long-term investing allows you to reinvest profits or dividends, letting the compound interest work and increasing profit potential. However, the benefits of compounding are not evident right away. For compounding to take form and to show results, again, you need uninterrupted time.

It is difficult for us to think exponentially. Human beings just aren’t wired that way. No surprise, then, that compound interest isn’t something people normally get excited about. The true gains from compounding will happen towards the end of your investment lifespan. Why? Because as your portfolio begins to get larger, the gains from compounding are more pronounced as the larger numbers multiply. To put it in perspective, Warren Buffett made more wealth over the age of 60, than anytime before. True wealth creation needs time, and compounding investment returns are no exception.

Understanding this should inspire people to start investing and saving early. The sooner you begin, the better, as the benefits from your patience in waiting will be realized sooner.

Managing emotions

Money is tied to emotions, especially those of fear, hope and greed. Such emotions can make it difficult for an investor to stay focused and make rational decisions. It may help to remember that the true measurement of investment success is in the progress made towards long-term goals. Thinking long-term allows you, the investor, to counter the always-prevalent knee-jerk, emotion-based reactions to market volatility.

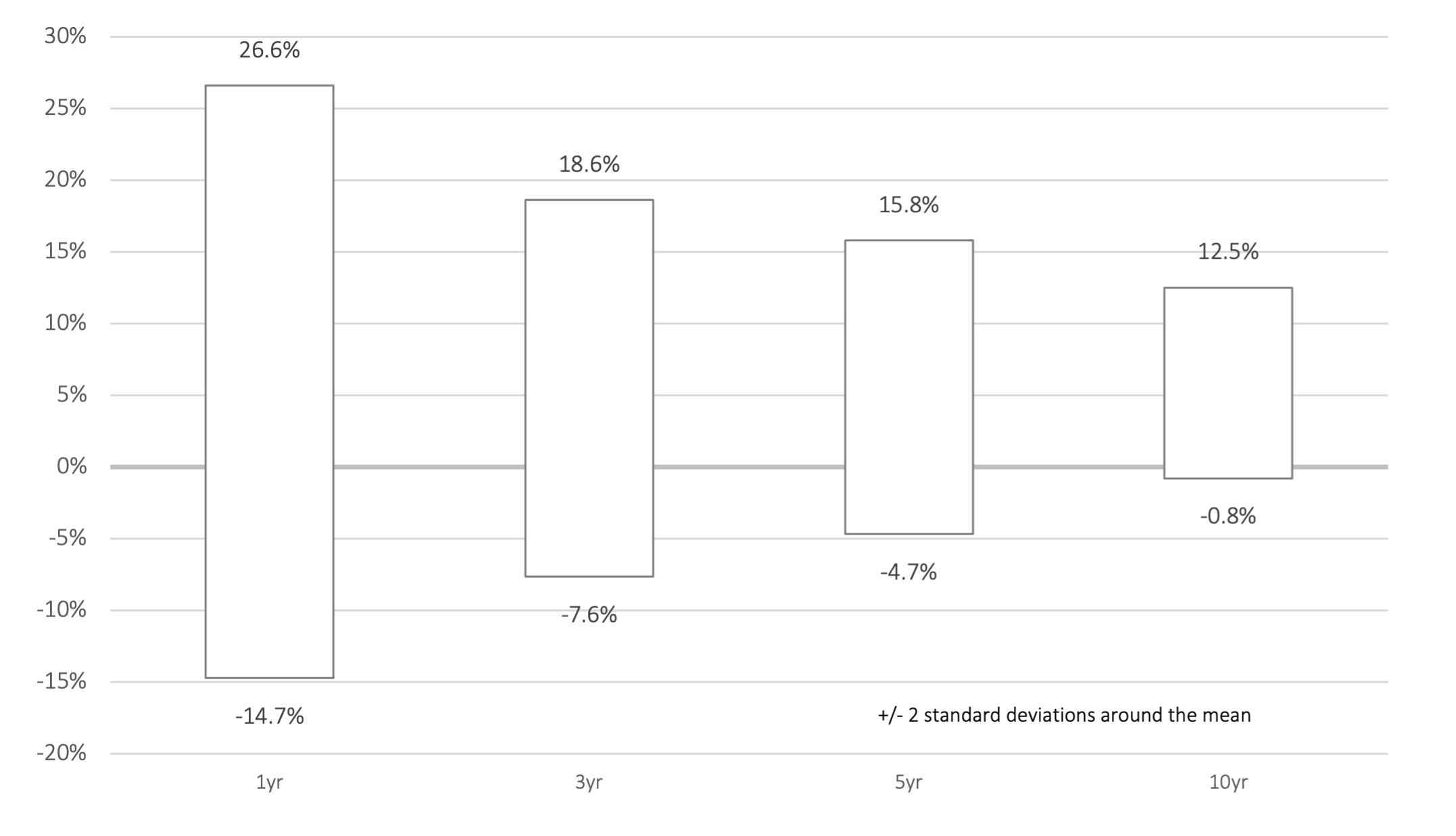

Looking ahead long-term, the greater the likelihood for the range of returns to tighten and for negative returns to decrease. As the chart below depicts (a standard 60% equity and 40% fixed-income portfolio), the following range of returns is expected to occur about 95% of the time, over varying time horizons. In this case, the long term will reduce the volatility in the range of returns (inflation-adjusted).

The best way to think long-term is to ask: What matters most to you? From answering that question, you can better understand the financial objectives you need to meet. What matters most, in the end, is just that: Meeting your long-term lifestyle objectives, as opposed to chasing the ups and downs of the market. Acting for the long-term means limiting emotional reactions and not interrupting the investment process.

Understanding short-term fears while emphasizing long-term needs is the best way to handle periodic bouts of volatility and avoid falling into the emotional traps of investing

In Closing

The markets will go up and the markets will go down. Take the cue from good golfers: Practise patience. Wealth appreciation is slow, it takes time, and you don’t need to be fancy.

If you need help building a long-term financial plan, please call us at 604-688-5262 or email info@ciccone-mckay.com.

Sources

Richard Bernstein Advisors, “Boomer Knows Best,” RBAdvisors.com, March 2021, rbadvisors.com/images/pdfs/RBA_Insights_Boomer_knows_best_03.21.pdf