Interest rates and growth are inversely related: Does this help or hurt your diversified portfolio?

By Vittorio Ciccone Investment Analyst - B.Com., M.Sc. - Louisbourg Investments Inc.

In the wake of higher inflation, central banks around the world raised interest rates. The effect of these increased rates has slowly been rippling through the economy.

Central Banks are hiking interest rates to slow the economy and curb inflation, which is good, for our current economic backdrop. However, there is a negative correlation between higher rates and the asset prices of stocks and bonds. This becomes a major factor in constructing well-diversified portfolios.

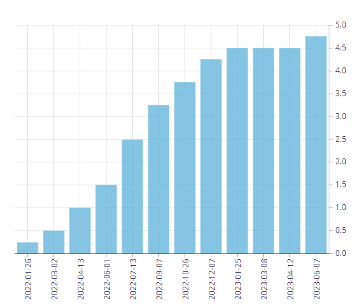

Figure 1: https://www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate/

Central banks are the biggest driver of interest rates. The banks tend to have two mandates: price stability and maximum employment. Adjusting interest rates ensures that both mandates stay within banks’ desired target range. Since January 26, 2022 in Canada, there have been nine interest rate rises. These have brought the Bank of Canada’s (BoC) policy rate from 0.25% to 4.75%.

As of now, the BoC has decided to re-start the interest-rate cycle after a brief pause and raise rates to 4.75%. The Bank’s assumption is that the ripple effect of the interest rate rises hasn’t fully worked its way through the financial system. During higher inflation, as now, price stability is top-of-mind for central banks. They need to slow the economy down – and policy rates are an important lever. High policy rates mean that: businesses and consumers borrow less; hiring will slow; and spending and incomes will fall. The opposite holds true for lowering rates, which spurs growth.

A by-product of central banks’ interest rate increases, as noted earlier, is how these correlate with an investment portfolio. Interest rates and inflation impact both stocks and bonds in varying directions. Let’s look more closely at this.

Bonds

The current financial environment has hurt bonds in many ways. For starters, take the effect of inflation. Typically bonds offer a steady stream of payments (a.k.a. coupons). Rising inflation makes the stream of those payments less valuable, as purchasing power is affected. However, with inflation higher, rates will increase. Bond prices and interest rates are inversely related – as interest rates rise, the prices of bonds tend to fall, and vice versa. Newer bonds are issued at higher prevailing interest rates, rendering the bonds with lower-coupon payments less valuable.

Not all bonds are affected equally. Bonds with shorter maturities tend to be less affected by the increase in interest rates. Bonds with longer maturities will incur a greater on-paper loss. Intuitively this makes sense, as longer-duration bonds have more coupon payments remaining. This puts at greater risk the value of their cash flows.

The dynamic of interest rates and bond prices is the reason for the past year’s volatility within the bond market. Prices are falling but yields are going up!

However, when it comes to constructing a well-diversified portfolio, there’s a silver lining. Since the 2008 financial crisis, interest rates across the world have been kept artificially lower due to monetary policy. A widely held belief in TINA, that is, there is no alternative to stocks, has prevailed. Now, with the new interest rate environment, many investors are starting to rethink the value of bonds within a portfolio. A Wall Street Journal article quotes David Lefkowitz, head of equities at UBS Global Wealth Management, as saying that “now you can finally get a yield in fixed income.”

As central banks look to tame the persistent inflation, they may hold rates higher for longer. On the one hand, this will help bond yields on traditional portfolios. On the other, it likely means a recession is imminent. That could be good news for your diversified portfolio. From his research, Derek Horstmeyes, a professor of finance at George Mason University, concludes, “In recessions going back the last 50 years, short-term bonds, long-term bonds and even high-yield bonds have delivered better average monthly returns than large-cap U.S. stocks.”

From a valuation standpoint, as rates are being held higher for longer, bond prices may look more attractive. Their prices are lower and their yields are higher, which can only help the return profile on a traditional 60/40 portfolio.

Equities

By contrast with bonds, rising interest rates have no direct impact on the stock market. However, when central banks make decisions on the rates, this does affect publicly traded companies and their future expected cashflows – and impacts stock prices.

In theory, increasing prices make share prices rise, which should translate to higher profits for companies. But a contraction of profits may occur, due to more expensive input costs.

As long as inputs do not increase at the same rate as revenue growth, nominal earnings growth should be positive. However, returning to a point I made earlier, central banks raise interest rates to slow the economy by making borrowing more expensive. Well, this forced slowdown trickles through to businesses and the consumer. It then, in turn, directly impacts publicly traded companies. Expansion plans and hiring will slow, hurting future earnings potential.

That said, the market will tend to discount those future earnings with higher rates. The reason: Like bonds, publicly traded equities tend to be valued by discounting the future cash flows to the present value. The higher the inflation, the less those cash flows are worth. So, as interest rates increase, future earnings discount rates are higher, combined with lower revenue growth. This equates to a lower total value of equities.

All this leads to repricing, i.e., future cash flows being discounted at higher rates. Consider the overall net impact of the higher expected nominal earnings versus higher discount rates. This impact determines how equities will behave in an environment of higher inflation.

Interestingly enough, as investors began to believe that central banks were slowing or even pausing the rate of increases, equities had a strong start to 2023. They were led by those same growth-tech names that were hit with a repricing in 2022. You can therefore see the dynamic that equities have with interest rates: Higher rates make valuations cheaper and, as rates begin to slow or come down, people invest in riskier assets.

Conclusion

Interest rates have a big impact on the overall economy. They also have an impact on the assets selected within a portfolio. It is important to understand how rates affect stocks, bonds and other asset classes. In a future blog post, I will discuss how interest rates impact other investments – such as real estate, commodities and more.

If you have questions or comments, please feel welcome to contact me: info@ciccone-mckay.com or call us at 604-688-5262.

Sources:

- Wall Street Journal: “Wall Street Concedes There Is Finally an Alternative to Stocks”

- Invesco QQQ Trust (QQQ)