Inflation:

What it is – and how to deal with it

By Vittorio Ciccone , B.Comm – Investment Analyst

The biggest risk over the coming year? Inflation, say three out of five U.S. investors. That’s according to Tony DeSpirito, a managing director at BlackRock, the world’s largest asset manager. While I don’t have a similar survey of Canadian investors, my friends, clients and colleagues tell me they feel the same.

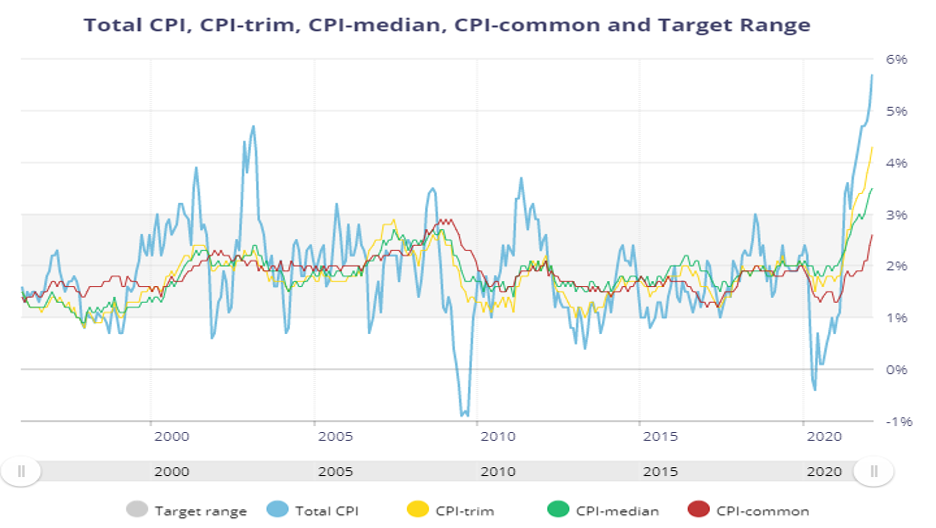

And no surprise. The cost of almost everything is up. The prices of gas, groceries and housing housing have increased dramatically since before the pandemic. The Bank of Canada is reporting the consumer price index (CPI) to be 5.70% as of February 2022. Total CPI hasn’t been this high in Canada since 2003. In the U.S., inflation has accelerated to upwards of 8%. For context, inflation in both countries has hovered in and around 2% over the last 15-plus years.

The chart above, from the Bank of Canada, shows how far current CPI numbers are from the Bank’s target range.

With inflation being unusually high, let’s look at what this means for you, as an investor.

What is inflation?

Inflation is the measure of the rate of price rise in goods and services. Inflation can affect any product or service, with no exceptions. Once inflation gets into the economy, it is hard to remove. The expectation of higher prices becomes a serious concern for businesses and consumers.

Inflation can be downright scary. It makes the dollar you earned today worth less in the future. In other words, you lose some of the consumption power of that dollar. For example, say your investment portfolio earns 7.5% but inflation is currently 5.70%. In real terms you’ll earn 1.80%.

Two factors drive inflation. First, an increase in production costs and an increase in demand for products and services. Higher production costs occur when raw materials and wages cost more. This added hit is pushed on the consumer in the form of higher prices.

Second, there’s demand pull inflation, the surge of consumer need for a particular good(s) within the economy. Over the short term, demand pull inflation isn’t much of a concern. It becomes more of a factor as the demand for the product impacts the supply chain by pulling other input costs higher.

Central banks globally have two simple mandates: low unemployment and inflation. Many central banks have set their inflation mandates to an average of 2%. As noted earlier, 2% is where inflation has hovered for the past 15 years. Currently global inflation is trending higher than 5%.

The most common measure of prices is the CPI. When prices on goods/services increase, it does, too.

The most common measure of prices is the CPI. When prices on goods/services increase, it does, too.

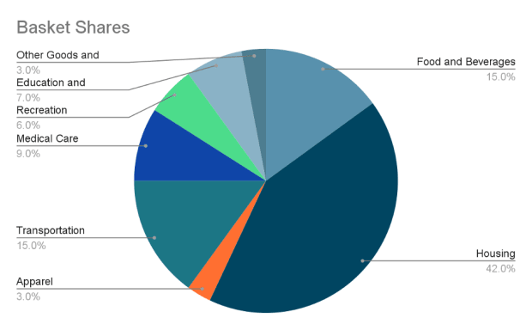

There are different measures of the CPI. Typically it is weighted by how much a typical household spends on certain items. But in some cases, more than 200 categories help determine the monthly CPI.

As you’ll see in the diagram to the right, Massi De Santis of TheStreet.com shows us a typical basket share of the CPI and what the weights look like.

What is happening now?

Russia is a significant exporter of energy and commodities to Europe. Due to the escalating Ukraine conflict, energy and commodity prices have shown extreme volatility, reaching new highs. This, in turn, has exacerbated the inflationary pressures already felt by consumers and businesses.

Even before the conflict in Ukraine, acute labour shortages, supply chain disruptions and input costs were emerging. At the same time, labour markets were improving after COVID lockdowns, and wages were rising. As well, consumer savings accumulated during the pandemic kept purchasing power strong.

Demand grew on businesses to increase production, despite their limited ability to do so. All of the above heightened inflationary pressures. The Russia-Ukraine conflict has only intensified these pre-existing conditions – which is why we are seeing such massive CPI readings.

So, how to handle inflation and your financial plan?

According to BlackRock, over the coming decades inflation is not expected to remain this high. Rather, as geopolitical tensions and COVID-caused supply-chain bottlenecks ease, inflation should settle back down into a comfortable range.

However, as I mentioned above, once inflation is in the system, it takes a while to flush out, and for the natural supply-and-demand dynamics to be rebalanced. Because of this, higher-than-normal prices in the service sector and even housing will remain high for the next while.

Entrenched inflation causes central banks to raise interest rates as a strategy for stabilizing prices. These dynamics, in turn, raise borrowing costs and slow economic growth. All this tends to add volatility to the stock market. As a result, investors, businesses and consumers struggle to navigate the changing environment.

So, what should you do?

Much of what happens depends on an investor’s age, risk tolerance and existing financial plan. The most important thing to note is the need to stick with your financial plan. Now isn’t the time to dump an asset class like bonds, even if they have been providing a little less ballast of late. Bonds are an important source of diversification.

According to Barrons, Vanguard is saying it will take 10 years of rolling inflation of higher than 3.5% for bonds to lose their diversification ability. To put this in context, core inflation would need to run higher than 5% over the next five years for that to be a legitimate issue.

Even in this environment, there is something to be said about looking at the overall value of your investment portfolio. Many prominent investments over the past few years have had extremely high valuations. As rates rise and risk gets repriced, those valuations will compress – leading to underperformance. History tells us stocks are still one of the best places to be in a rising inflation environment.

The allocation breakdown depends on your ability and willingness to take risk. The key is to develop an investment plan that is right for you. If you’re an investor drawing on your portfolio for income, having short-duration bonds or gaining exposure to real estate could be beneficial. On the other hand, a younger investor with a longer time horizon could benefit from maintaining their stock exposure.

Another thing to note is that, in a lower-rate world, the cash sitting in your bank is daily losing value. Consider putting excess cash every month in your investment vehicle of choice. As we’ve written in a previous article, the excess cash should be held as an emergency account. Should the unexpected happen and a critical need arise, this account could then fund short-term day-to-day needs.

The fact is, in a higher price environment you want to be careful about excess spending. Check out our article on budget-setting and find areas to reduce excess spending. It is important to build space within your financial budget to adjust to every circumstance.

Yes, inflation can be scary – but remember that fear is temporary. Stick with the financial plan you’ve set. This will allow you to stay the course –and to stay secure, no matter what.

Sources:

An equity investor’s guide to inflation | AdvisorAnalyst.com

Inflation Is Here to Stay. How to Adjust Your Portfolio. | Barron’s (barrons.com)

How High Is Inflation and What Causes It? What to Know –– WSJ

Key Inflation Indicators and the Target Range –– Bank of Canada

How to protect your money during inflation, according to eight financial planners | Fortune

To learn more, email us at info@ciccone-mckay.com or call us at 604-688-5262.