The investing risk that really matters

By Vittorio Ciccone , B.Comm – Investment Analyst

As investors, we purchase stocks, bonds and alternatives in the hope of realizing the greatest dollar return. With stocks, the return largely comes with the capital gain on the asset price, plus any income from dividends. With bonds, the return depends on how much income the coupons generate, plus any appreciation on capital.

We pay for our returns through the risks we take in investing. Within wealth management, the traditional definition of risk isn’t that helpful. In just about every textbook, authors define risk as standard deviation or volatility. Both standard deviation and volatility measure essentially the same thing: the degree of variation from the mean/average price. If you’re an academic, this statistical measurement is easy to quantify. But the risk we Main-Street-type investors care about is far more down-to-earth. For us, risk is not having enough financial assets when we need them most – for retirement, purchase of a large asset, etc.

As countless blogs explain, there are time-tested strategies on how to reduce volatility within a portfolio:

- Long time horizon — allows you to embrace volatility and align your investments with your goals.

- Diversification — having assets that are not correlated reduces the large swings within your portfolio.

- Alternative asset classes — these strategies include real estate or hedge funds. Both are historically proven to reduce your exposures to large downturns.

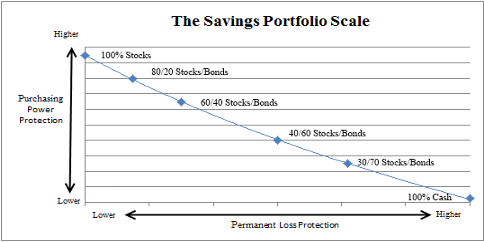

Myself, I believe a true understanding of risk in a portfolio is twofold: purchasing power risk and permanent loss risk. Permanent loss risk is when your assets are declining in value, and you are forced to take a loss. Purchasing power risk is when your savings may not beat the rate of inflation. (Roche, 2015.)

Cullen Roche’s Savings Portfolio Scale (pictured) shows that, for investors to be protected against permanent loss, they should be invested 100% in cash. And if they want to protect against purchasing power loss, they should be invested 100% in stocks.

However, either strategy may cause your portfolio to fall victim to the two risks stated above. Having your investments somewhere in the middle will tend to allow enough growth to pass inflation. Also, enough security to protect against permanent loss – a top priority for most of us.

Whatever strategy you choose comes with trade-offs. For some strategies you will need time, giving you the ability to ignore daily fluctuations. Other strategies require greater cost; some may expose you to risks such as liquidity or execution, that is, completing a buy or sell order.

The point of all this being – there is no free lunch. But by viewing total portfolio risk as described above, you can realistically gauge how risk will apply to your own portfolio.

Because It is not enough to try to control risk. You must understand how you will react to it.

To have a conversation about where you may be on the Savings Portfolio Scale, please feel welcome to contact us: info@ciccone-mckay.com or call us at 604-688-5262.

Sources: