Unit 2 – Time Value of Money

Lesson 2.1: Introduction to the Time Value of Money

Congratulations! You have just won a lottery that will pay you $1,000,000. However, after looking at the fine print, you discover that you are required to choose how you will accept this payment. You can either:

- Accept the $1,000,000 over 20 years ($50,000 per year); or,

- Take a lump-sum payment of $625,000

Why is the lump-sum payment in Option B a lesser number than the cumulative payments you would receive in Option A?

This is due to the focus of Unit 2: The Time Value of Money.

Time Value of Money (TVM) is a financial concept that describes why a dollar today is worth more than a dollar tomorrow. There are two main reasons why money in the present is worth more than an equal amount in the future: Inflation and Opportunity Cost.

- Inflation

Inflation is a phenomenon in which the prices of goods and services increase gradually over time. Ever wonder why the price for a burger and a coke was $0.05 in the 1950’s but today, the same meal would cost several dollars? This is the power of inflation: over time your Purchasing Power — the amount of things you can buy with a specific amount of money — is diminished by the constant increase in prices. Simply put, a dollar today will buy you less goods and services as time progresses due to inflation.

Measured as a percentage, inflation is accounted for by the rate of average price change for goods and services included within the Canadian Consumer Price Index (CPI). From groceries to electricity to haircuts, the CPI includes a wide variety of goods and services Canadians consume to provide a best estimate as to the effects of inflation. This is one reason why a dollar today should be worth more to you than a dollar in 10 years: because it will likely buy less things in the future.

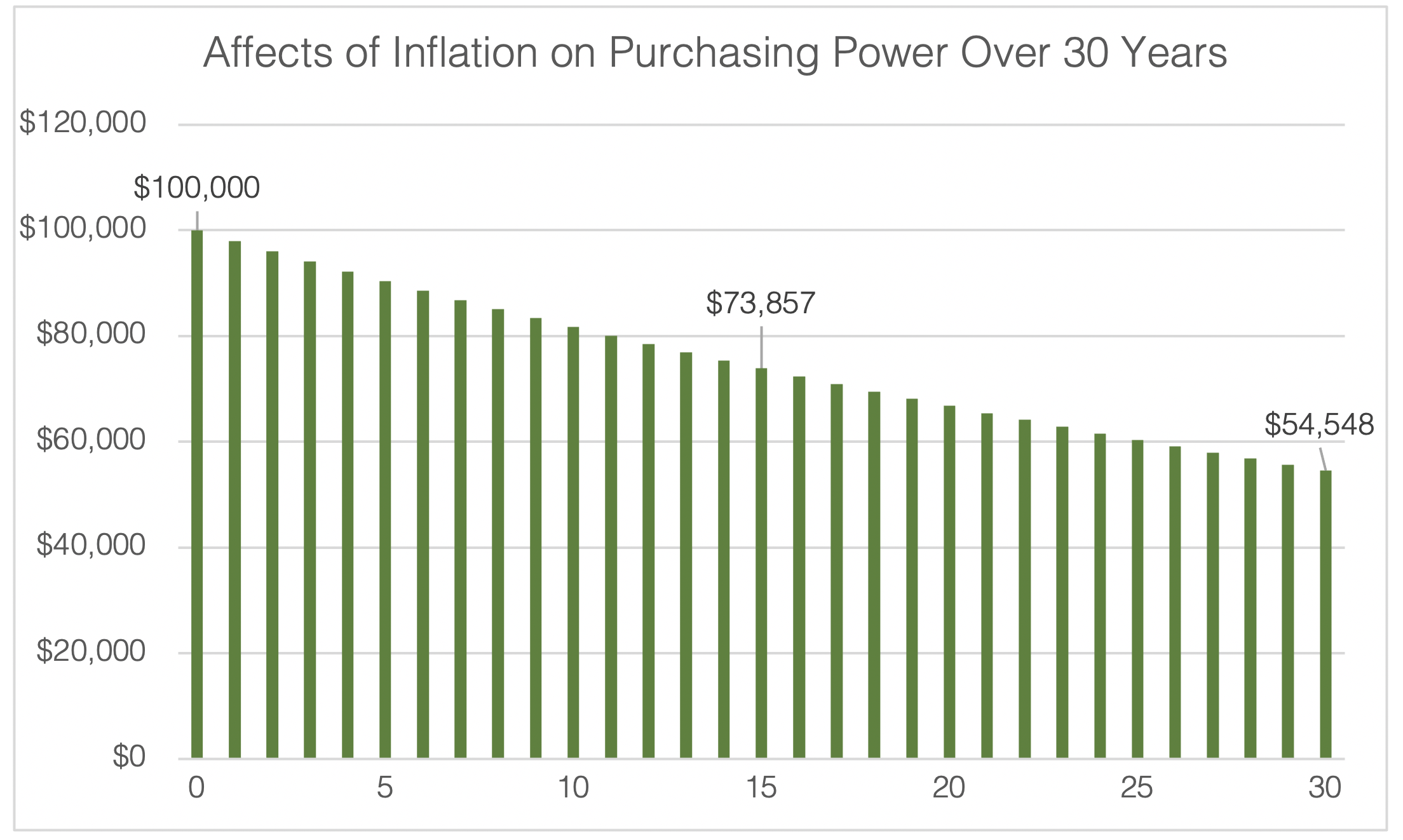

As you can see in the graphic above, in Year 1, you are able to purchase $100,000 worth of goods and services with $100,000. However, in an environment with a steady inflation rate of 2.00%, by Year 30, $100,000 will be able to buy you only $54,548 worth of those same goods and services.

- Opportunity Cost

With money comes opportunity, and following this opportunity comes a cost over time. Opportunity Cost describes the benefits an individual forgoes when choosing one alternative over any others.

For example, you go to an ice-cream shop that serves three flavours: vanilla, strawberry, and chocolate. By selecting vanilla, you have forgone your opportunity to enjoy both strawberry and chocolate. In comparison, you go to an ice-cream shop that serves 100 flavours. By selecting one, you have now forgone the opportunity of enjoying the other 99 by your selection. As these two scenarios portray, the greater your choices, the greater your Opportunity Cost.

Transitioning back to Opportunity Cost’s relevance to finance, let’s say you invest in a savings account which locks your money in the account for a 1-year period, you receive a guaranteed interest rate, but you have now forgone any other use of this money for the next 12 months. You could buy something that you have wanted for a while, pay off some debt, or invested these assets, but instead you have chosen to put it into this savings account. Those other opportunities you have given up for the next year would culminate in conveying your Opportunity Cost.

As it relates back to our original example of the lottery win, in Option B you are provided a lump-sum payment less than the total income stream of Option A because you are now provided the opportunity to go out and invest this money over the course of the next 20 years, which may provide you with more wealth by the end of the 20 years.

In Lesson 2.2, we will go on to detail how the Time Value of Money Calculation is utilized in the financial planning process, and how the calculations for comparing scenarios are created.