Unit 1 – Income Taxes

Lesson 4: Investment Income and the Tax Effect

Before I begin discussing the different ways in which different investment vehicles earn their income, and the effect this has on how they are taxed, I should reference the last two lessons that I posted regarding an overview of tax. These lessons scratch the surface of how the Canadian tax system was established, what is considered taxable income, and how tax rates are determined. I believe that if you take the time to read the information provided in the previous two lessons, this article will make a whole lot more sense.

As I discussed in Lesson 1: What are Taxes & Where Did They Come From, there are three types of investment income: interest income, dividend income, and capital gain growth. Each one is earned in a different way, and hence each one is taxed in a different way. In this lesson I will highlight all three sources of income and compare them to one another.

Interest Income

Interest Income is the easiest of the three to understand. Simply put, interest income is the revenue earned by an investor by lending his or her assets. For many Canadians, this form of investment income is experienced through savings accounts or Guaranteed Interest Contracts (GICs). In these examples, a predetermined interest amount is paid periodically to the investor and is usually guaranteed in one capacity or another.

Interest income is taxed at 100% of an investor’s Marginal Tax Rate (MTR). (If you are unfamiliar with the term Marginal Tax Rateplease refer to Lesson 2: Tax Brackets, Average Tax Rat, & Marginal Tax Rates) . The way interest income is taxed is like that of employment income. Every dollar earned by means of interest income is taxed. For example, if you have earned $1,000 by means of a GIC, and your Marginal Tax Rate is 28%, you will owe $280 in taxes, and your net income remaining is $720.

Dividend Income

Dividend Income is the most complex form of investment income for sure. Corporations can pay dividends to their shareholders, and there are several factors that determine how much tax will be owed. The main distinction between what taxes might be expected, comes down to the potential tax credits to which a Canadian investor may be entitled, but this depends on a few factors surrounding the dividend payment.

One of the most significant factors that affects the taxation of a dividend is whether the corporation paying this dividend is a Canadian company or not. These dividends paid by Canadian corporations are divided into two groups: eligible and non-eligible dividends. If the dividend payments are deemed to be eligible dividends, then the investor benefits from preferential tax treatment in relation to non-eligible dividends. If an investor receives a dividend from a foreign corporation, then the amount received is taxable in full, at his or her MTR.

I won’t go into the exact details as to how the taxes are calculated for eligible dividends, however, I wanted to identify the taxable implications of holding shares of a corporation. If the dividend income received is eligible for tax credits, it will yield less tax for the same amount of income than that of interest income.

Even in the case of using Registered Investment Accounts (such as a Tax-Free Savings Account or Registered Retirement Savings Plan), there may be withholding tax associated with foreign dividends.

Capital Gain

Capital Gain is a concept that is tremendously important to grasp, as the ramifications of the taxes associated with the growth can be momentous. Capital Gain is the amount by which an asset has grown in value from the time of purchase until the time of its sale. This type of investment income is commonly seen when a person invests in assets in which growth is commonly seen over the long term, such as stocks, funds, properties, etc.

To calculate what is owed in taxes for the Capital Gain for an asset you firstly take the market value at the time of purchase, and subtract that from the market value at the time of the sale of the asset. For example, if you were to buy a house for $1.0 million and it grew to $1.5 million at which point you sold, you would be left with a Capital Gain of $500,000 ($1.5 million - $1.0 million). From here, you can determine the taxable amount of growth by taking 50% of the Capital Gain, in this case $250,000 ($500,000 / 2). Finally, to determine how much taxes are owed, you take the taxable amount ($250,000) and multiply that by your MTR (let’s say 30% for simplicity). In this end, you would be obligated to pay $75,000 in taxes, bringing your net profit down to $425,000.

Although capital gain growth is the most tax efficient method of investment income, the fact that it may arise after many years of owning an asset leads to the potential for a colossal tax bill when it comes time for the investor to sell the asset. This is presented for individuals who personally own real estate outside of their primary residence. For these pieces of real estate, referred to as investment properties, the effects of capital gain tax will play a huge role in the profitability of these projects.

Summary

Obviously, this is a basic explanation. In subsequent articles I will discuss situations in which investors are incentivized to hold certain assets in specific accounts to minimize or eliminate the implications that taxes have on their investments. But that is another topic for another time.

Example – Interest Income vs Capital Gains

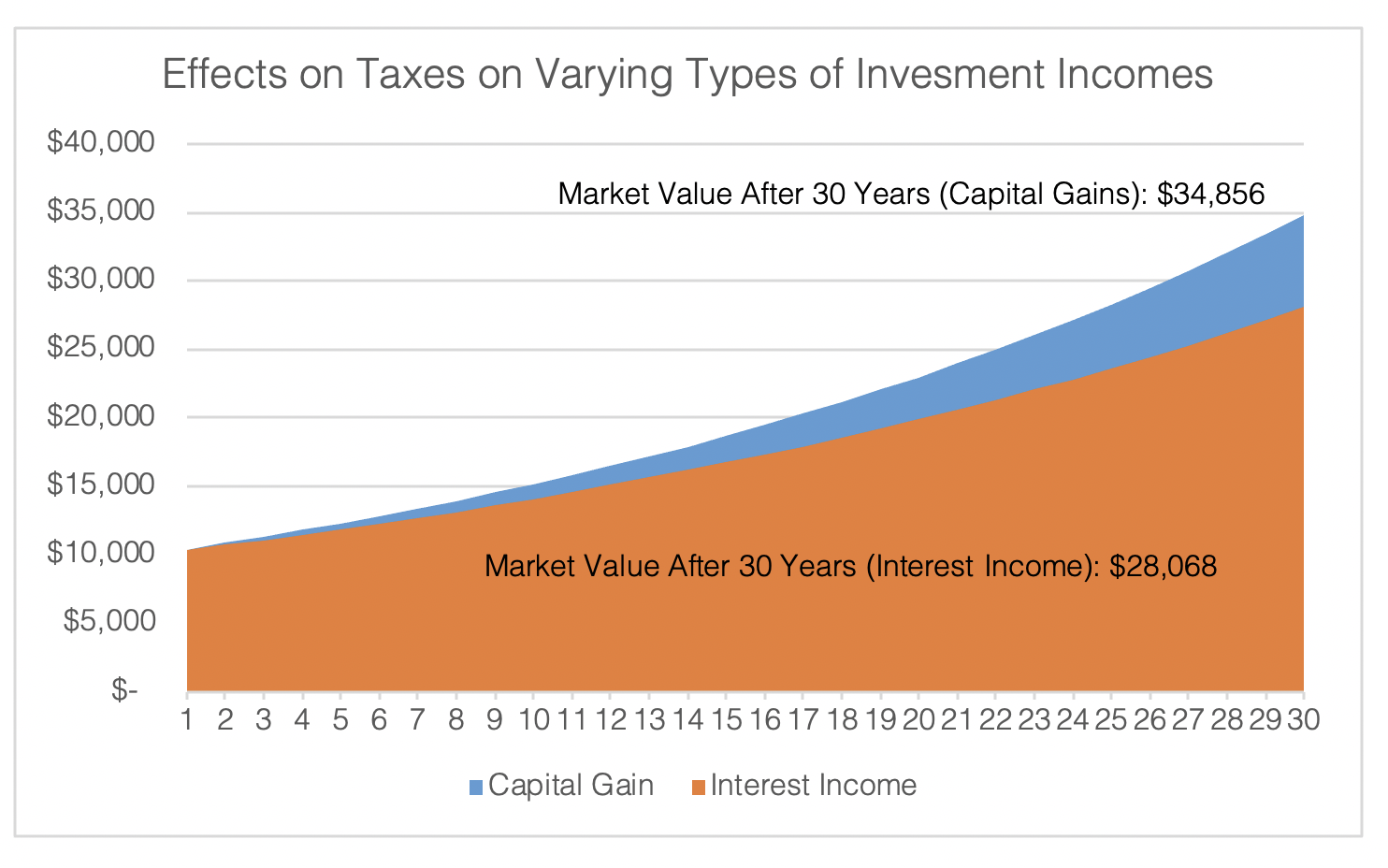

As a means of displaying the effects of taxable income earned through investing, I have created a hypothetical comparison between Interest Income and Capital Gains over the course of 30 years. As discussed earlier, the reason I have chosen to compare Interest Income and Capital Gains is because Interest Income is the most taxed form of investment income, while capital gains carry the least influence of taxes.

In this example, I made the following assumptions:

- Initial Investment of $10,000 with no additional deposits

- Assets are held within the investment for 30 years

- Average Tax Rate of 30.00%

- Rate of Return for both the Interest Income and Capital Gain example of 5.00%

Clearly, the way in which you invest, or the investment products you employ, can make a significant impact on the end results of your investment strategy. Considering the tax implications of the assets you own will enable you to strategize on how to minimize the effects of taxes on your investments and may impact your investment decisions going forward.

In the next Lesson, my colleague Vittorio Ciccone will provide the details behind including Dividend producing income within your portfolio, and how this yields an impact on your taxable investment income.

.png)